Traders utilize sentiment factors from both Twitter and StockTwits to confirm social sentiment or...

Enhancing Overnight Momentum with Twitter Sentiment: An Updated Trading Strategy

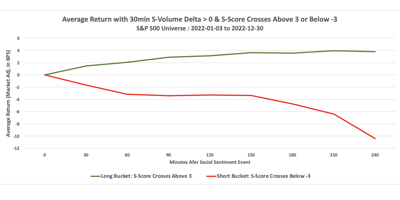

In the summer of 2022, at Context Analytics we explored the interaction between overnight momentum and the corresponding overnight sentiment change. Our initial findings revealed a reversion to the mean pattern in stocks priced over $5. Specifically, we observed that when stocks dipped overnight, they tended to rebound from open to close the following day. Conversely, when stocks rose overnight, they tended to drop back down during the same period.

We then examined the change in Twitter's S-Score from the previous close to the market open, aligning this with the overnight stock movements. Our research uncovered that when the sentiment change contradicted the overnight movement—such as a stock dropping overnight but our sentiment change being extremely positive—it enhanced the indicator of a positive reversion to the mean. The reverse held true for positive momentum and extreme negative sentiment change.

The purpose of this blog is to update this trading strategy with out-of-sample results to verify if the observed trend has persisted.

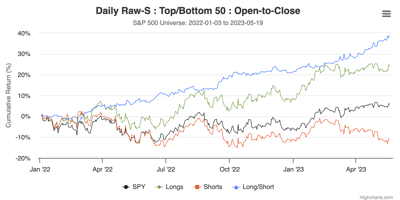

Rolling 3-Year Performance

Our analysis of the rolling 3-year chart reveals changes in sentiment significantly enhance momentum reversion. An extreme positive sentiment change increased returns on the negative momentum portfolio by nearly 50% cumulatively. Conversely, an extreme negative sentiment change decreased returns on the positive momentum portfolio by over 20% over this period. For comparison, we included the SPY as a baseline, providing a useful benchmark against our enhanced strategy.

Year-to-Date Performance

Examining the year-to-date performance, we observed consistent behavior with our previous findings. Our sentiment change yielded nearly a 3% increase on the long side and a nearly 6% decrease on the short side. These results highlight the robustness of incorporating Twitter sentiment from Context Analytics to augment standard trading signals.

This research provides a concrete example of how Twitter sentiment can be leveraged to enhance traditional trading strategies. By integrating sentiment analysis with overnight momentum, traders can gain a more nuanced understanding of market movements and potentially achieve better returns.

For more detailed information on our methodology and findings, visit www.contextanalytics-ai.com or click the button below.