Intraday Alpha

Using intraday Social Sentiment monitoring can inform traders of any changes in market conditions and help them act fast. Stocks that have extremely positive sentiment from recent Twitter conversation, outperform the market over the subsequent hours.

Context Analytics supplies a variety of Social Sentiment factors updating at different frequencies. We decided to investigate how intraday shifts in Twitter sentiment affects the stock’s subsequent price movement. Context Analytics delivers a social sentiment score called S-Score which ranges between -4.25 and 4.25. The S-Score is predictive of future price movement when it moves closer to the extreme values. For this reason, we decided to investigate price returns in the subsequent hours after the S-Score crosses above 3 or below -3. For the event to be triggered, there must be an increase in Twitter volume as well.

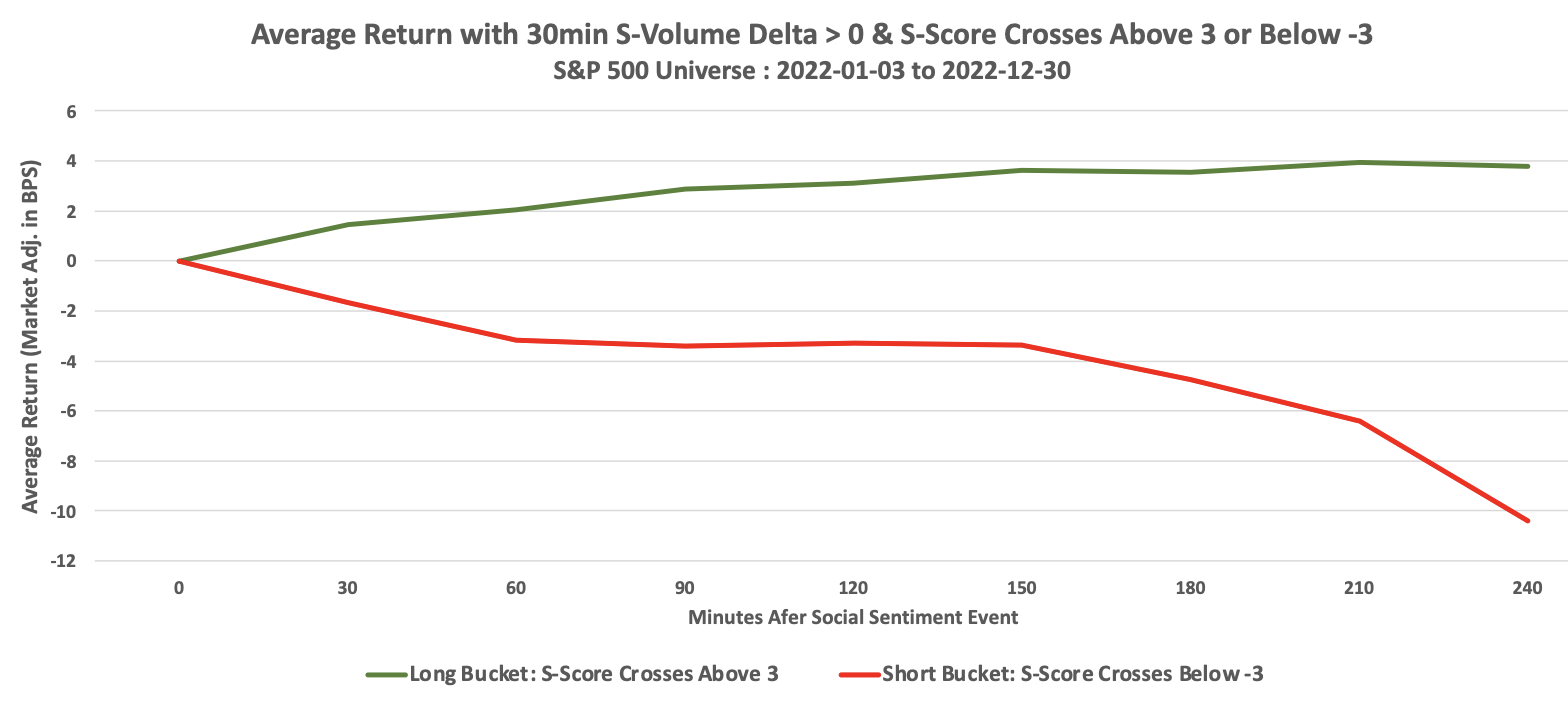

In this test we look at price returns in 30-minute intervals after the Social Sentiment event is triggered. The return is subtracted by SPY’s return over that same period to adjust for different market conditions throughout the year. We take the average benchmark adjusted return in intervals of 30 minutes for all securities triggered, up to 4 hours. Below is a graph demonstrating the power of identifying securities with extreme Social Sentiment

The y-axis is the average return above/below SPY in basis points. This tells you that 240 minutes (4 hours) after the Social Sentiment event is triggered, securities with the positive events outperform the benchmark by 0.04% and negative events underperform by -0.10%. This test was run on Context Analytics’ 2022 dataset and only includes securities in the S&P 500.

Throughout 2022, there were on average 15.7 and 5.6 securities in the Long and Short Bucket each day. Because there must be an increase in Twitter volume and extreme sentiment during market hours, the percentage of actionable signals per day is under 5% of the S&P 500 Universe.

Social Sentiment has become an influential data point in financial securities and there are a variety of other applications using Context Analytics unique factors. For more information, click the button below or email us at ContactUS@ContextAnalytics-AI.com.