Quantitative News Follow Up Study

Following our initial research on Context Analytics’ Quantitative News Feed sentiment with daily close-to-close returns, we conducted a follow-up study to evaluate its effectiveness so far in 2024. If you're unfamiliar with our methodology, we suggest referring to our previous blog for detailed information: News Widget Key Features

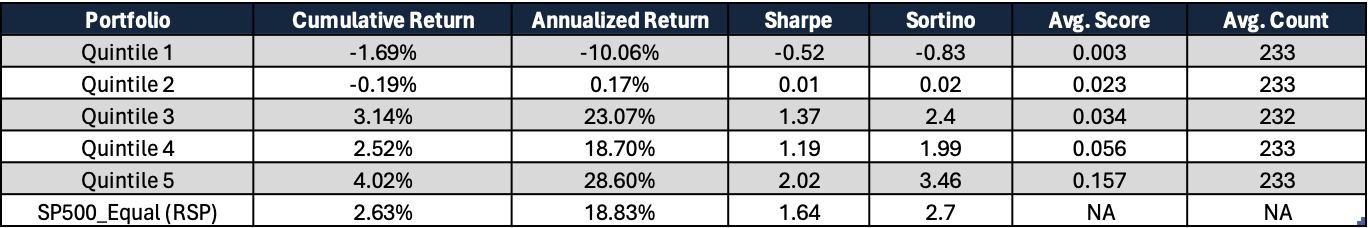

Over the first two months of 2024, our analysis reaffirms consistent patterns across quintiles, lending further credibility to our findings. Once again, we observe a gradual spread through the top and bottom quintiles with this out-of-sample data.

Notably, the bottom quintile, which comprises companies with the most negative news over the preceding 24 hours, experiences a decline of close to 2%. This decline persists despite the overall positive market performance this year. Conversely, the top quintile displays outperformance. Companies in this category not only surpass the S&P 500 constituents but also show notable improvements in Sharpe and Sortino ratios compared to the baseline. These findings underscore the potential utility of leveraging news sentiment as a strategic tool in navigating market volatility and identifying promising opportunities.

For those interested in exploring our quantitative news feed or requesting a trial, please don't hesitate to contact us via the link below or visit our website www.contextanalytics-ai.com .