Quantitative News Feed Product Intro Blog

At Context Analytics, we pride ourselves on being at the forefront of harnessing unstructured financial data to provide actionable insights for investors. We are thrilled to announce the launch of our newest data source: news articles.

Since our inception, Context Analytics has been a trailblazer in leveraging diverse sources of unstructured financial data. Our primary channels have included social media sentiment from platforms like Twitter and StockTwits, as well as sentiment analysis of corporate filings. These sources provided valuable insights into market sentiment and trends. Our news data feed is a large addition to these proven predictive sources.

In real-time, we ingest articles from over 3000 news sources, covering more than 4000 unique companies. With our proprietary natural language processing (NLP) technology, we analyze and score news articles at the individual article level, producing sentiment metrics that are usable in trading decisions. Importantly, these metrics are independent of sentiment data from social media platforms, offering a unique perspective on market sentiment.

One example metric we developed using our news data is the Daily News Raw Score. This metric is calculated by aggregating sentiment scores from news articles over the previous 24 hours for each company in our dataset. The calculation is as follows (Where x represents the date, N the number of articles for a company in that 24-hour period, and i the individual news article):

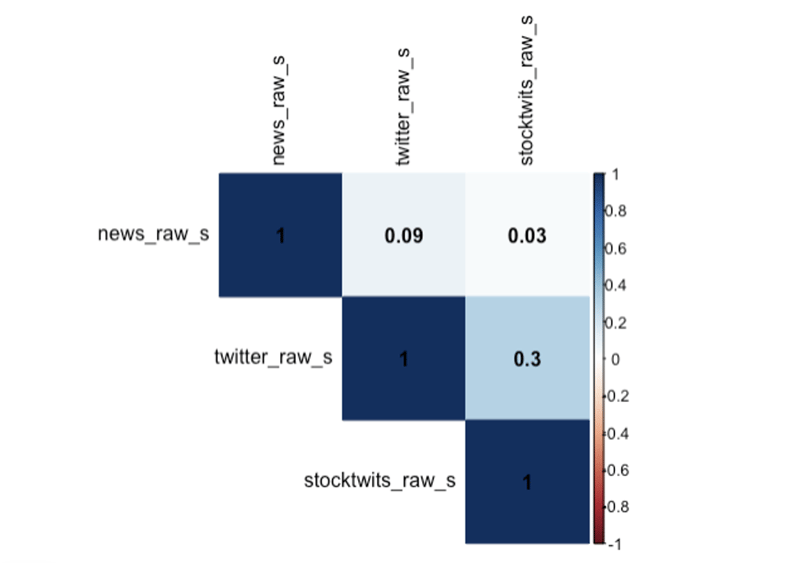

This metric closely resembles the 'Raw-S' sentiment factor in our Twitter and StockTwits feed. However, as indicated by the correlation matrix presented below, the Daily Raw News Score presents a metric that is not strongly correlated with our other sources. Notably, the Twitter_raw_s and StockTwits_raw_s are derived from the same 24-hour period and the same stock.

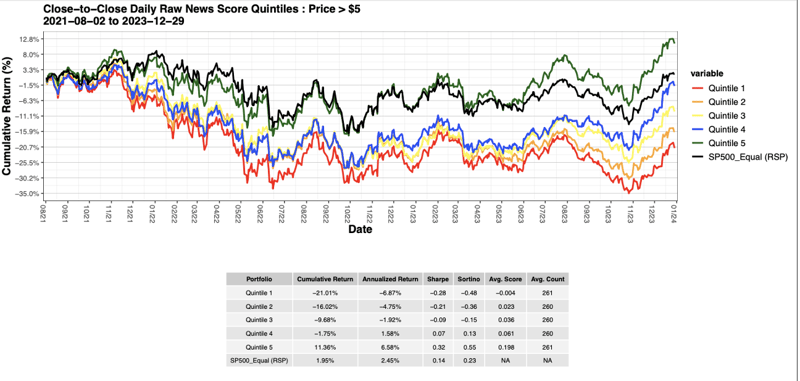

We then divide the scores into quintiles daily, with quintile 5 representing companies with the most positive news sentiment and quintile 1 representing those with the most negative sentiment. The remaining quintiles represent incremental steps between these extremes. In analyzing the performance of companies across these quintiles over a two-year period, we've observed compelling results.

Notably, companies in the top quintile consistently outperform the S&P 500 Equal Weighted ETF (RSP), serving as a testament to the predictive power of our news data. Furthermore, there is a clear monotonic spread in performance across subsequent quintiles, with quintile 1 underperforming by over 20% during the observed timeframe.

These findings underscore the correlation between sentiment from news articles and subsequent market returns, highlighting the value proposition of our news data feed for investors. The implications extend beyond mere performance metrics, offering actionable insights for traders and fund managers alike. Whether it's identifying potential winners or avoiding underperformers, our news data opens a variety of opportunities for strategic decision-making.

This example of the Daily News Raw Score is merely scratching the surface of the myriad ways in which our news data feed can be leveraged in the stock market. There is a plethora of methods to aggregate and manipulate this granular data feed for both longer and shorter holding periods.

For more information on our news feed or to request a trial, we invite you to reach out to us via email at ContactUS@contextanalytics-ai.com or visit our click the button below!