Extension: 8-K Negativity Percentage

Last week, we delved into the sentiment analysis of 8-K filings and its impact on subsequent security returns. We devised a strategy based on tertiles to compare different levels of negativity and analyze their correlation with future returns. If you need background information on how we calculate the negativity percentage, you can refer to our previous blog here: 8-K Negativity Blog .

Taking our research a step further, we developed a threshold strategy utilizing the Negativity Percentage. Instead of categorizing companies into tertiles, we employed a static threshold of 60% to identify companies with exceedingly negative filings. It’s worth noting that this threshold is arbitrary, but 60% signifies a filing with significantly more than half its content being negative. We created a daily portfolio of companies that filed 8-Ks with more than 60% negativity. More specifically, we enter each company that meets this threshold at the market close of the day the filing was released. Each security is held in the portfolio for 5 days with returns calculated daily. The universe includes any US Equity with a Price > $5.

Based on our earlier research, we anticipated that this portfolio would exhibit poor performance. To gauge performance against the broader market, we computed the daily returns of the SPX, which tracks the S&P 500 and reflects overall market performance. This comparison allowed us to underscore the potential impact of negative 8-K filings.

We initiated this daily bucketing strategy at the outset of 2020.

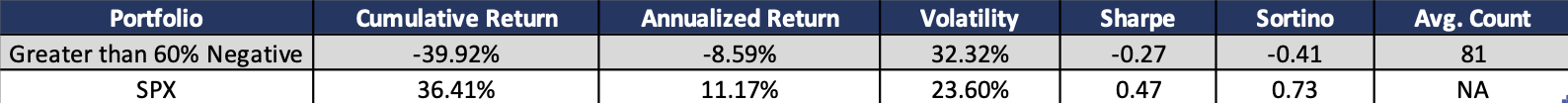

Over this period, we observed a similar effect as our previous research. Companies submitting 8-Ks with more than 60% negativity significantly underperformed when compared to the overall market. This portfolio experienced a decline of over 40%, while the market gained 36%. It's important to note that this portfolio contained an average of 81 companies each day during this period, indicating a robust sample size. As a result, we conclude there is a correlation between negative 8-K filings and subsequent poor market performance.

For information on accessing 8-K sentiment data or any of our other products, click the button below or reach out to us via email at ContactUs@contextanalytics-ai.com .