8-K Negativity Percentage

An 8-K filing is a report filed by publicly traded companies with the U.S. Securities and Exchange Commission (SEC) to announce significant events or material information. They often contain negative news decision-makers need to react swiftly. In this blog, we explore the importance of 8-K filings, the potential negative information they can contain, and the significance of analyzing them for risk assessment.

8-K filings are a vital component of financial transparency. Companies are required to file these reports within four business days of certain key events, such as earnings releases, executive changes, mergers, acquisitions, and other material developments. Investors rely on these filings to make informed decisions about buying, selling, or holding a company's stock. They provide a window into a company's operations, strategy, and overall health.

One crucial aspect of 8-K filings is that they often contain negative information that can significantly impact a company's stock price. This negative information can include financial losses, regulatory issues, litigation, and other adverse developments. Investors need to be vigilant and analyze these filings to assess the potential risks associated with holding a particular stock.

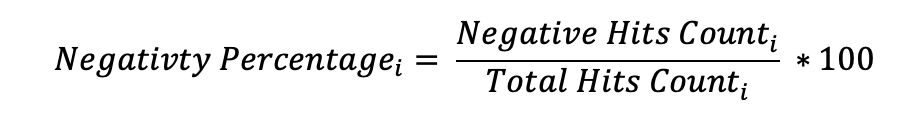

Leveraging our proprietary natural language processing technology, Context Analytics assesses 8-K filings in real time, offering a comprehensive array of sentiment metrics to provide insight into these critical documents. The metric employed in this research is the Negativity Percentage, which is computed by dividing the count of negative hits by the total hit count. A negative hit refers to the presence of negative words or phrases within the document, while the total hit encompasses any instance of indicative words or phrases. In this formula, 'i' represents the index of the 8-K filing.

The Negativity Percentage is a standardized metric that quantifies the negative content within an 8-K filing. A higher Negativity Percentage indicates that the filing contains a significant amount of negative information. Conversely, a lower Negativity Percentage suggests a more positive filing.

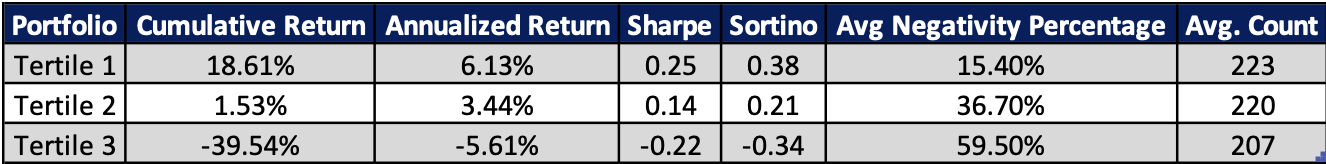

We examined the short-term effects of negative 8-K filings from various companies. Each day we bucketed all companies that released an 8-K filing into Tertiles based on their Negativity Percentage, with the highest Tertile (top 33%) representing the most negative filings and the lowest Tertile (bottom 33 %) indicating the most positive filings. Daily returns were calculated for each Tertile, and stocks were held for five days following the release of the 8-K filing. In cases where multiple 8-K filings were released for one company in the period, we took the average score.

We traded with these Tertiles since the beginning of 2018.

The time series chart illustrates a correlation between negative 8-K filings and subsequent returns. Notably, the data reveals that annual returns turn negative for the highest Tertile of Negativity Percentage. Within this bucket, the average percentage stands at 59.50%, indicating that when more than half of the document is negative in tone, it serves as a robust indicator of forthcoming market underperformance.

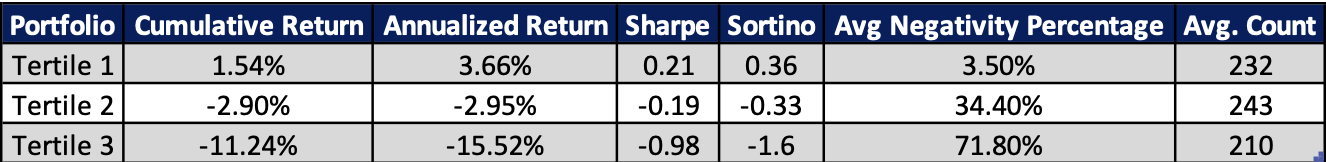

Building on this insight, we conducted an analysis of recent trends by examining year-to-date data.

We observed this trend persist in recent data. What's particularly noteworthy is the high Negativity Percentage, which stands at 71.80% for the top Tertile. This figure reflects a higher level of negativity compared to the historical data from the past five years. This year, the top Tertile portfolio has experienced a decline of over 11%, in stark contrast to the SPY, which has seen a year-to-date increase of 12%. This performance gap displays the tangible impact negative 8-K filings have on a company’s stock. It underscores the importance of closely monitoring these filings and their associated sentiments when making investment decisions.

The incorporation of sentiment metrics from Context Analytics significantly enhances the accessibility and depth of analysis when dissecting 8-K filings. It is imperative for market participants to maintain a vigilant watch over 8-K filings and respond promptly to any negative disclosures. Furthermore, 8-K filings serve as a valuable resource for risk assessment. By closely monitoring the sentiment within these documents, investors can gain insights into potential risks associated with specific companies or industries. For additional information on the capabilities of Context Analytics, click the button below or email us at ContactUs@contextanalytics-ai.com .