Weekly Raw Sentiment Long Only

Social Sentiment from Twitter can be used over multiple trading horizons. Using aggregations of Tweet sentiment from the previous 5 market days is predictive of weekly returns. A Long only portfolio using weekly raw sentiment outperforms the S&P 500 by 4.5% annually over the 5+ year period.

There are a variety of ways users can utilize Context Analytics’ S-Factor feed. One way is by creating aggregations from the 24-hour metrics in the S-Factor by security to create weekly or monthly metrics. These aggregated metrics are more helpful for longer trading horizons.

In this strategy we use `Raw-S`, which is the 24-hour summation of sentiment from Tweets in that time. A 5-day rolling summation of `Raw-S` is taken by security to determine the most positive securities on Twitter over the last week. Sentiment data is taken from market days only, which is why a 5-day rolling summation is used instead of 7-days.

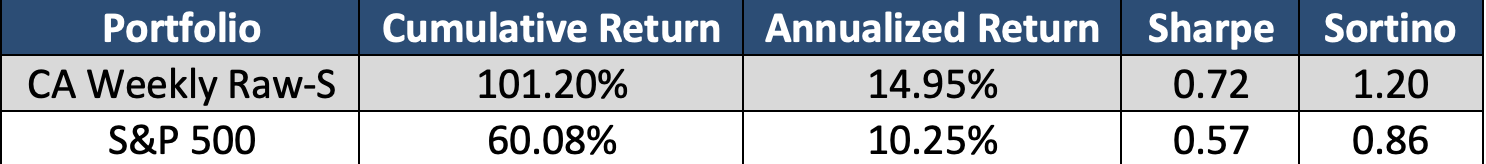

The strategy below is a weekly strategy that rebalances at Market Open of each week’s last market day. A universe of S&P 500 stocks is used with the Index serving as the benchmark. At the end of each week, the Top 25 stocks in the S&P 500 Universe with the highest 5-day rolling summation of `Raw-S` are selected and equally weighted in the Longs portfolio below. Below is a graph and summary statistics showing the performance of these high positive sentiment securities as a portfolio.

Over the course of the 5-year period, the Weekly Raw-S portfolio has consistently outperformed the S&P 500. This time frame includes multiple bull and bear runs, highlighting the portfolio’s flexibility in leveraging sentiment data regardless of the market’s condition. The sample portfolio surpassed the benchmark by over 40% cumulatively and increased the Sharpe and Sortino ratios. This portfolio includes 25 stocks, equally weighted, and rebalanced once a week.

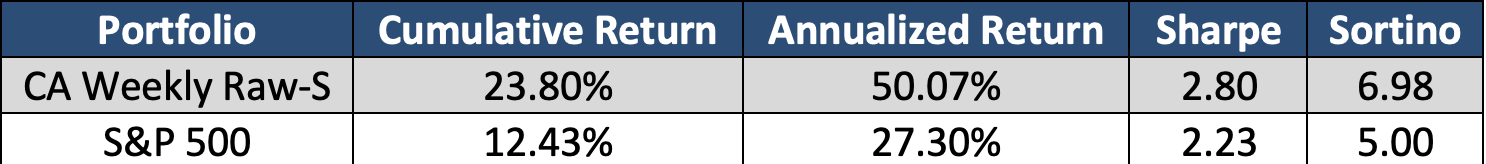

Looking at the performance on a more recent time enhances the performance. Below is the performance of the same strategy year-to-date.

The S&P 500 has performed well in 2023 with over 12% return already. The Weekly Raw-S portfolio nearly doubles that return so far in 2023.

Social Sentiment can enhance a trader’s stock selection and decision making. Context Analytics’ partnership with Twitter enables users to ingest unique Social Sentiment data. There are many other ways to utilize this unique dataset. For more information, click the button below or email us at ContactUS@ContextAnalytics-AI.com.