UDT Case Study: Maui Wildfires

Hawaiian Electric Industries (HEI) is a Hawaiian-based family of companies that holds the responsibility of providing power to over 95% of the native population through its extensive electric utility infrastructure. This intricate network supplies 95% of households and businesses in the region.

Tragedy struck on August 8th when a series of wildfires spread through Maui ignited by a combination of factors. Heavy winds stemming from nearby hurricanes brought down power HEI power lines. Hot, arid weather conditions created an environment for the rapid spread of fire. Regrettably, these wildfires resulted in the destruction of significant portions of Maui and the loss of many lives.

The focal point of this blog revolves around the exploration of the potential role of the Unstructured Data Terminal (UDT) from Context Analytics in recognizing risks and facilitating swift responses to such dire events in the future.

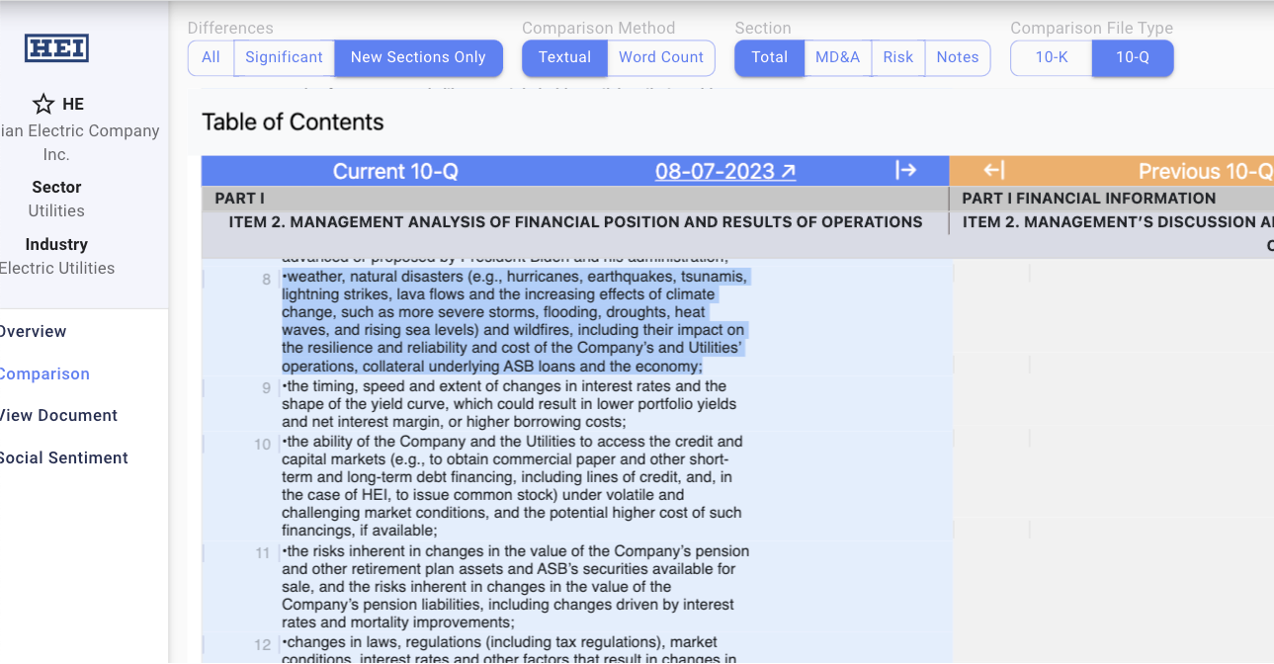

There have been multiple lawsuits filed against Hawaiian Electric Industries. The primary allegation is HEI neglected to take appropriate action despite receiving ample warnings from the National Weather Service. Specifically, the lawsuits contend that HEI made the decision not to deactivate power lines during periods marked by High Wind Watch and Red Flag Warning conditions. Utilizing the capabilities of UDT, we observe HEI did acknowledge the potential risks associated with severe storms and their potential impact on operational aspects.

HEI's quarterly report which predates the onset of the wildfires reveals a significant awareness of these inherent risks, with a clear understanding that they held the potential to disrupt regular operations. The unsettling aftermath of the wildfires has taken a toll on HEI's stock value, leading to a substantial decrease since the fires.

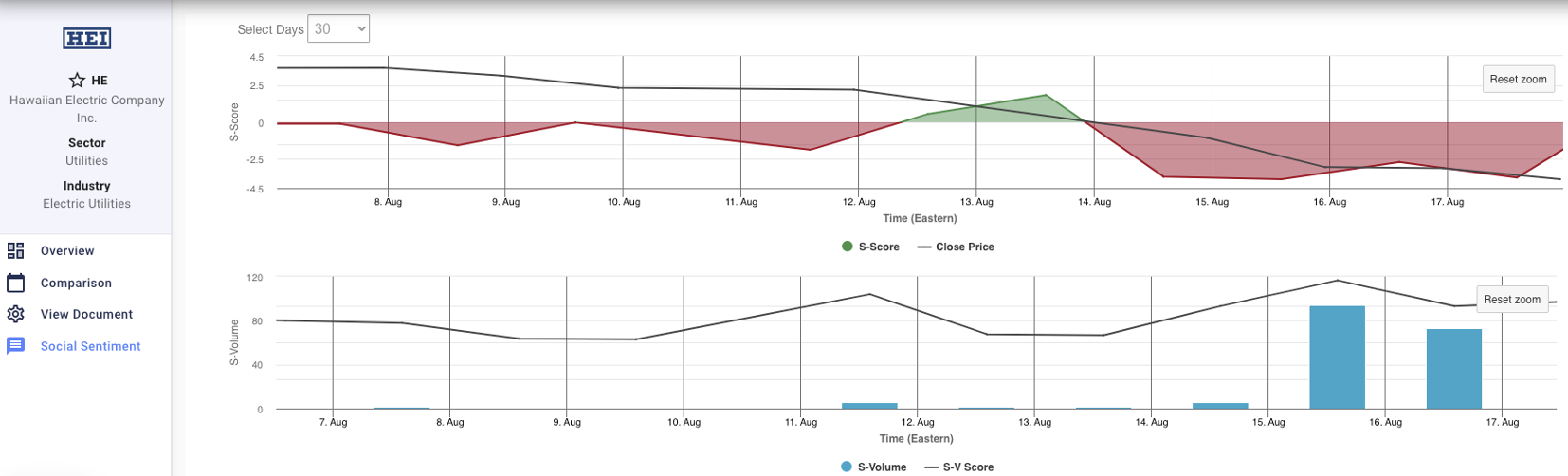

UDT allows us to delve into the social sentiment surrounding HEI as these events continue to unfold. Sentiment analysis can provide valuable insights into the perceptions and emotions of the public regarding HEI's actions, responses, and responsibilities during this crisis.'

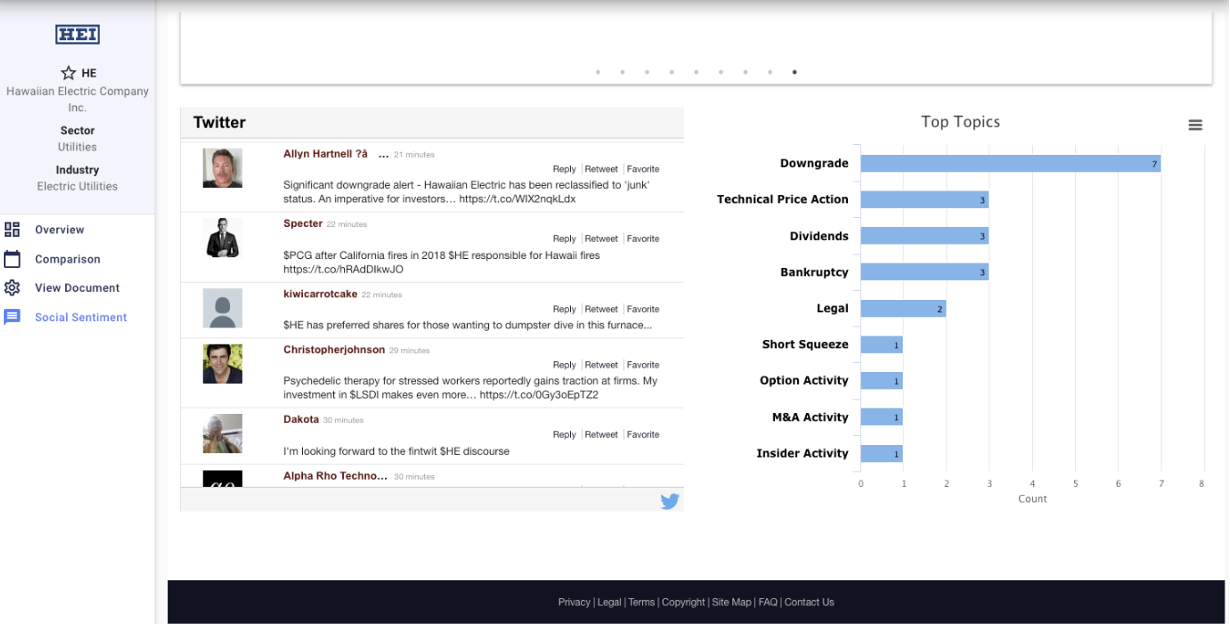

There was a substantial influx of negative sentiment prior to the decline in stock price. During this period, a spike in tweet volume indicating heightened activity and attention occurred. An analysis of topics discussed reveals a distinct focus on terms such as 'downgrade' and 'legal.' These thematic markers align with the unfolding current events, shedding light on the prevailing concerns related to the company's financial outlook and potential legal ramifications.

This view also offers live tweets related to HEI's actions and the ongoing situation. By leveraging this real-time, we gain a more immediate and unfiltered view of how individuals are responding to the company's crisis management efforts, potential legal repercussions, and overall performance. This live tweet stream supplements our view with concrete instances of sentiment expressed by various stakeholders, offering a deeper understanding of the evolving narrative as it unfolds.

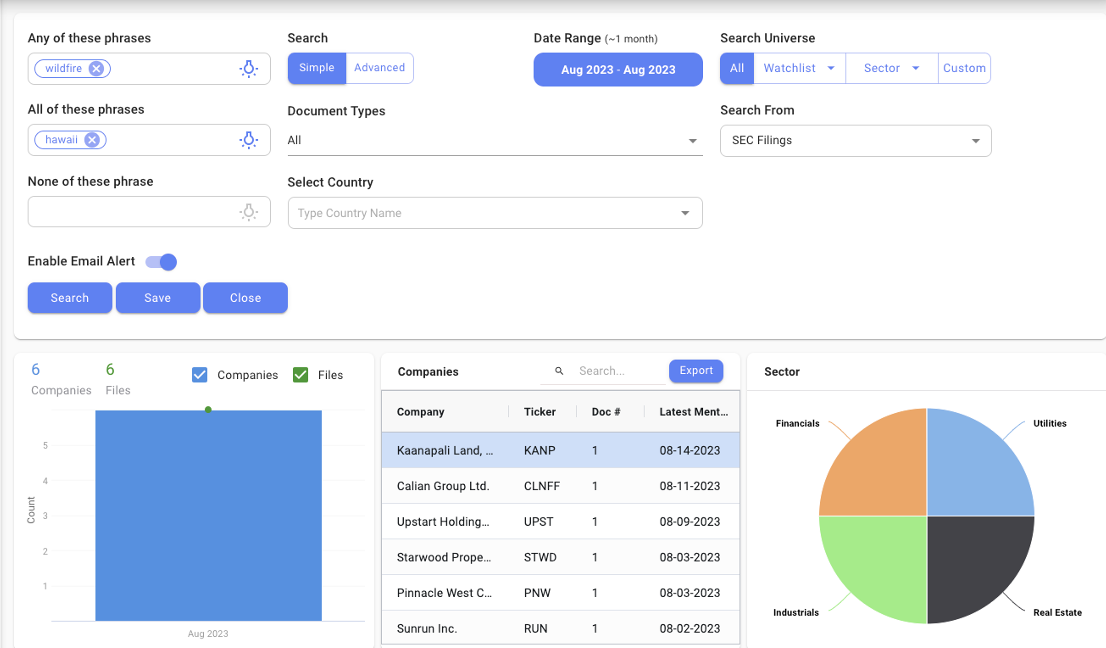

Through UDT we can search for other potentially impacted companies using the ThemeX tool. This allows us to proactively identify other companies that might be negatively impacted by the wildfires. For instance, we can execute searches targeting companies that have made references to both 'Wildfire' and 'Hawaii' within their most recent filings.

The most recent company with these mentions is Kaanapali Land LLC, a real estate management and development company. By selecting this company, we can take a closer look into their references directly in the filing. In their 10-Q published on August 14th, they make a point to include the recent wildfire as a risk to their operational results.

The Maui Wildfires were profoundly tragic. Beyond immediate effects, these events unveil numerous layers that can be analyzed through UDT by Context Analytics. The presented case study serves as a demonstration to underscore the capabilities of UDT in aiding decision-makers and risk assessors in comprehensively navigating ongoing crises. By delving into the interplay of SEC filings, sentiment analysis, and thematic exploration, UDT equips professionals with insights for informed decision-making amid the complexities of real-time events. For more information on the Unstructured Data Terminal, visit our website www.contextanalytics-ai.com or click the button below!