ThemeX Index: Increased Recurring Revenue

Intro: By using Context Analytics’ ThemeX search capabilities, users can create custom portfolios from its results. A search on ‘Increased Recurring Revenue’ yields a variety of securities that are grouped into a Monthly Long Only portfolio which outperforms the market by over 4.5% annually over a 10+ year sample.

Context Analytics’ Unstructured Data Terminal (UDT) has a variety of tools to identify key information in regulatory documents from companies in the US and globally. One of those tools is ThemeX, a custom search engine that scans Context Analytics full repository of global regulatory filings and provides a summary of documents/companies that match the criteria. From these results you can create custom portfolios containing these securities and validate your investment ideas.

Using ThemeX, we decided to search for companies that mentioned having an increase in recurring revenue in their 10-K or 10-Qs. The theory is that recurring revenue is indicative of future revenues because the revenues are expected to continue. Whereas other forms of revenue are lagging indicators of revenue.

For the search, we looked for sentences which mentioned “recurring” “revenue” and “increased” or “subscription revenues” and “increased” within a 50-character proximity in the same sentence. We then added ‘Not’s on “costs” and “non-recurring” to avoid capturing mentions of recurring revenue costs increasing or non-recurring revenue increasing.

From this search, there were 1608 documents from 2011 through 2022 from 231 unique companies. The number of documents is relatively low because the topic model is specific and we are searching on only 10-Ks and 10-Qs, which come out quarterly. More document types are available on the ThemeX platform.

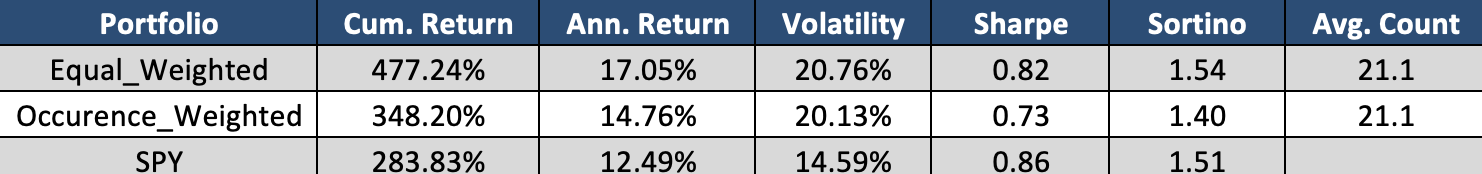

We then created a Long only portfolio using these companies, which is rebalanced monthly at market close of the last market day of each month. Stocks that have matched the ‘Increased Recurring Revenue’ search over the past month are included in the portfolio at the end of the month and are held up to 4 months. This long-term holding period is appropriate with regulatory filing data as it’s a quarterly data frequency. Below are the results of the portfolio:

From the securities that matched the ‘Increase Recurring Revenue’ topic model, we also tested two weighting schemes. The first portfolio was an equal weight of securities that matched the criteria. The second was where securities are weighted by the number of times ‘Increase Recurring Revenue’ phrases were mentioned within the company’s filings over the past 3 months.

Both weighting schemes outperform the benchmark, SPY. However, the equal weighted portfolio significantly outperforms the occurrence weighted portfolio. Over this 10+ year history there are an average of 21 securities in the portfolio each month with a higher number in 2022 (~40 per month). An equal weighted portfolio of this ThemeX search outperforms SPY by over 4.5% annually, proving the usefulness of ThemeX for portfolio selection.

With tools like ThemeX, users can create searches on investment hypothesis or topics of interest and incorporate companies with the desired attributes. ThemeX is a tool to monitor and extract information on emerging trends while ultimately enhancing stock selection. UDT also allows for ThemeX alerts so when a new document hits a saved search, you can be notified instantly. For more information on how UDT’s ThemeX can enhance your investing experience, click the link below or email us at ContactUS@ContextAnalytics-AI.com.