StockTwits Real Estate Indicator

In the realm of investments, diversification plays a crucial role in reducing risks and maximizing returns. The real estate market is often viewed as an attractive alternative asset class for portfolio diversification due to its lower correlation with other sectors. In this blog, we explore the behavior of the real estate market using sentiment metrics from Context Analytics. By analyzing sentiment from StockTwits, the study identifies negative days and employs a strategy to enhance index performance.

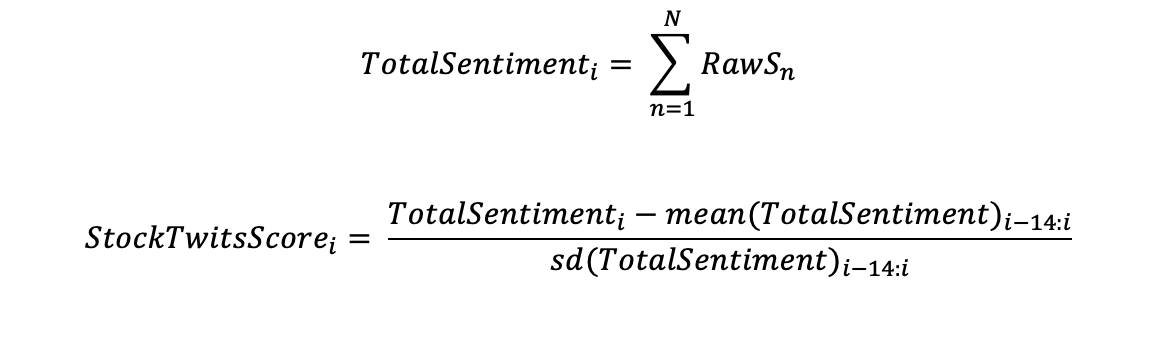

We collected sentiment data from StockTwits at 3:40pm ET, 20 minutes before market close. The sentiment data was obtained for every security within the real estate sector. This came out to 150+ unique tickers each year in the study. We then aggregated the the `raw-s` of every security for that day and standardized it over a 14-day period to create the StockTwits Score (Raw-S being the raw sentiment surrounding the security from all posts in the previous 24 hours). The purpose was to create a proxy for the sentiment surrounding the entire real estate market. The calculation for this is shown below, where N represents the number of tickers with sentiment for that day and i represents the day:

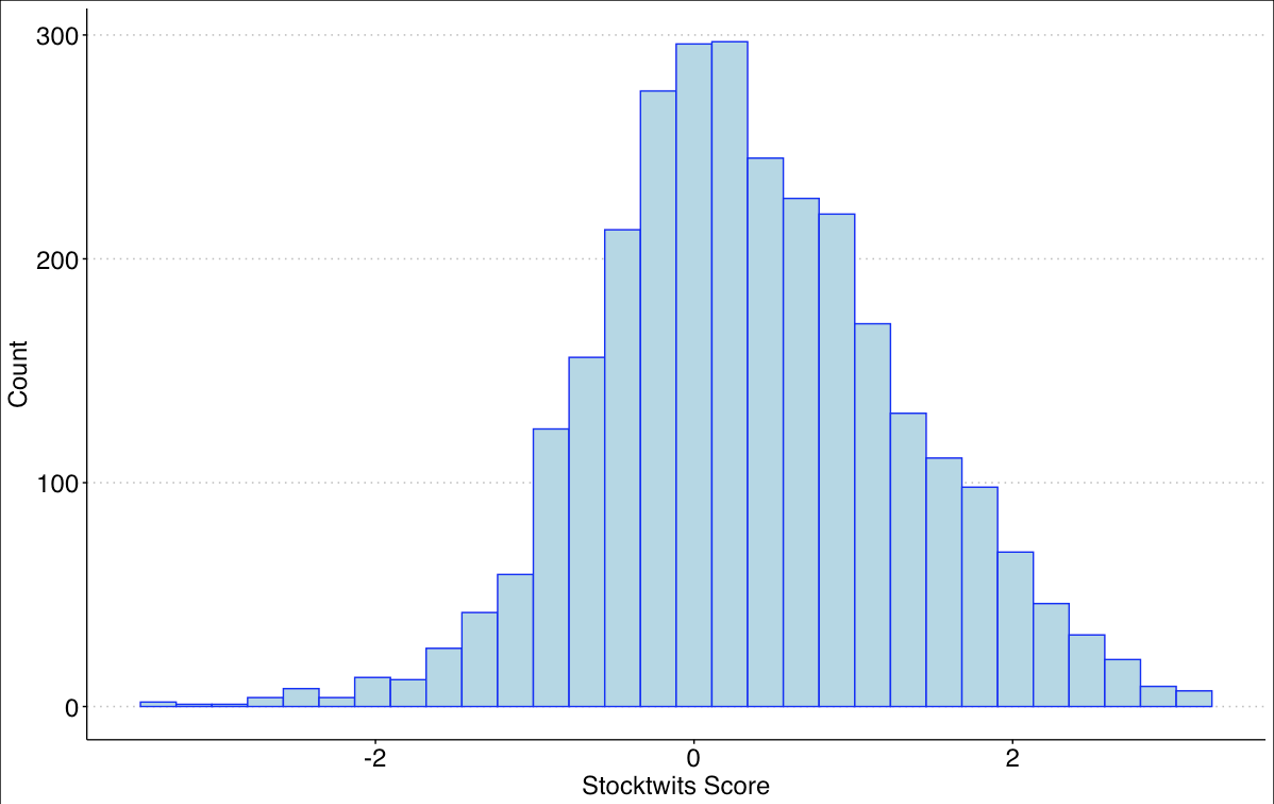

The resulting metric exhibited a close approximation to a normal distribution, ensuring consistent behavior over the entire time frame of the study. A histogram of the StockTwits Score is shown below:

To capture the broader real estate market's behavior, the Vanguard Real Estate Index Fund (VNQ) was utilized. VNQ has over $32 billion in total assets and has daily trading volume of over 5 million. By leveraging the StockTwits Score, we looked to identify negative days, indicating bearish sentiment in the real estate market.

Based on the distribution of the score, we set a threshold of negativity at -.75. So, we classified a day with a score less than -.75 as a negative signal. To test this identification, we created a simple trading strategy using just the VNQ. For each day that we classified as negative, we took a theoretical short position against the VNQ for the subsequent close-to-close. For every other day, we held a full long position of the VNQ. In theory, we not only stay out of the market on the negative days but also take advantage of them.

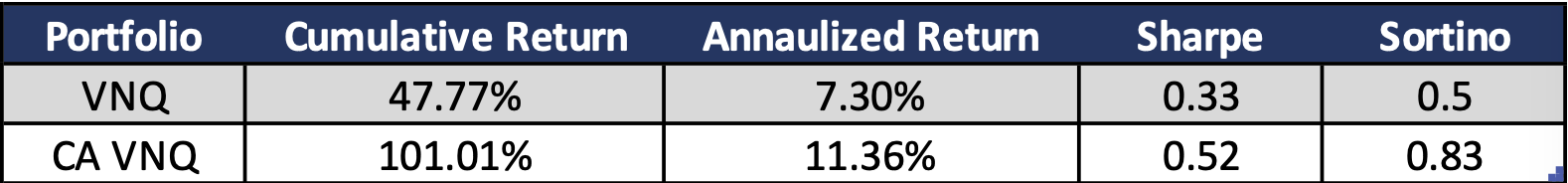

We assessed the performance of this strategy by analyzing daily close-to-close returns since the beginning of 2016, using sentiment from a consistent sample of over 150 companies in the real estate sector. The results were promising - the annual return saw a notable increase of 4.3%, and the cumulative return showed a significant rise of 54%. Additionally, both the Sharpe and Sortino ratios, risk-adjusted performance metrics, demonstrated marked improvements.

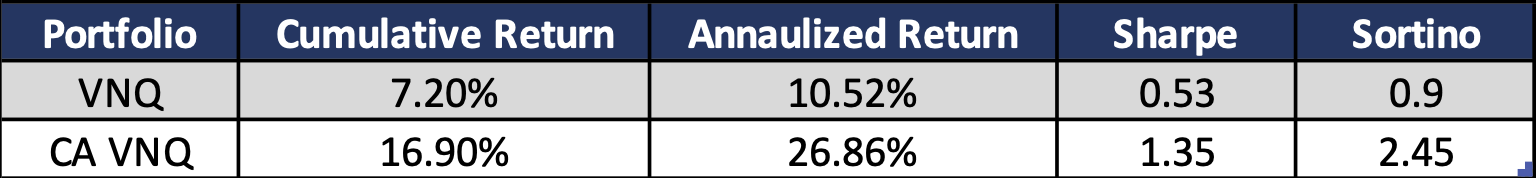

In a year-to-date analysis, the cumulative return exhibited a 9% increase, while the annualized return rose by an impressive 16%. Once again, the Sharpe and Sortino ratios showed notable enhancements. These findings underscore the advantages of employing sentiment metrics from Context Analytics to identify negative days in the real estate market, leading to improved investment returns.

In conclusion, the research study demonstrates the potential benefits of using sentiment data from Context Analytics, specifically from StockTwits, to enhance investment performance in the real estate market. Aggregating sentiment scores from a consistent sample of over 150 companies in the real estate sector to create a proxy for the entire market helps identify negative days. By leveraging sentiment data to identify negative days in the real estate market, investors can potentially mitigate risks and improve their returns. The relatively low correlation of the real estate market with other sectors makes it a great asset class for portfolio diversification, and incorporating sentiment from Context Analytics provides an additional tool to make informed investment decisions. Overall, this research provides valuable insights into the potential benefits of Context Analytics. For more information click the button below or email us at contactus@contextanalytics-ai.com