StockTwits Commodity Trading

In this blog post, we explore the commodities markets and delve into the role of sentiment analysis on the StockTwits platform in influencing trading decisions.

Futures and commodities markets are vital components of the financial landscape. Futures contracts allow investors to buy or sell an asset at a predetermined price on a future date. Commodities, ranging from agricultural products to energy resources, serve as the underlying assets for these contracts. Investors trade futures for various reasons, including speculation, hedging against price fluctuations, and portfolio diversification.

StockTwits, a social media platform dedicated to financial discussions, has emerged as a hub for traders and investors to share insights and opinions. Users on StockTwits engage in real-time conversations about stocks, commodities, and futures, contributing to a vast pool of market sentiments.

One of Context Analytics (CA) most popular metrics is the S-Score. The S-Score describes the sentiment on the current StockTwits conversation relative to the commodity’s historical baseline. Sentiment is scored using CA’s proprietary Natural Language Processing and messages are aggregated over certain periods with historical means and standard deviations also calculated. The S-Score is a z-score using these Sentiment values.

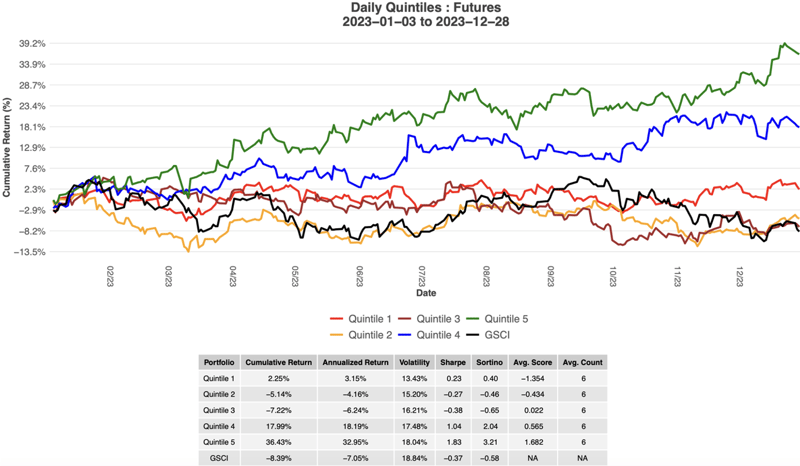

In this research, we focused on sentiment analysis at a specific time slot. At 9:25 am ET, just before the market opens, we captured the S-Score for over 50 unique commodities discussed on StockTwits. We bucket these commodities into Quintiles based on their S-Score. Quintile 5 represents the most positive 20% sentiment commodities, Quintile 4 represents the next most positive 20%, and so on. Initiating trades at 9:30 am ET, we calculated daily returns based on these quintiles. This systematic approach allowed us to explore the correlation between sentiment and trading outcomes. We traded for all of 2023.

Our findings for the year 2023 revealed a compelling correlation between extreme positive sentiment on StockTwits and excess returns in the futures market. Commodities in the top quintile returned an impressive 36%, while the second-highest quintile yielded an 18% return. Interestingly, the remaining quintiles experienced negative returns. To provide a benchmark, we compared our results against the S&P GSCI, a commodity futures index widely used as a proxy for the market.

In conclusion, our research indicates that monitoring extremely positive sentiment on StockTwits can be a valuable tool for futures traders. The correlation between sentiment and excess returns suggests that social media discussions can influence commodity market dynamics. For more information on how sentiment from Context Analytics can be leveraged in trading markets, visit www.contextanalytics-ai.com or email us at ContactUs@contextanlalytics-ai.com .