Social Sentiment on Silicon Valley Bank Collapse

Yesterday, we discussed how investors could have seen the collapse of SIVB coming through regulatory filings. There were multiple red flags throughout recent 8-Ks and 10-K that pointed towards SIVB being exposed to risk. Today, we will look at how Social Sentiment created by Context Analytics played a role in capturing the dramatic shift in SIVB’s price.

Context Analytics creates Social Sentiment metrics on each security by ingesting Twitter messages and aggregating sentiment created with patented Natural Language Processing. These aggregations occur on the security level and are compared to the individual security’s historical baseline to get a standardized view of sentiment by company.

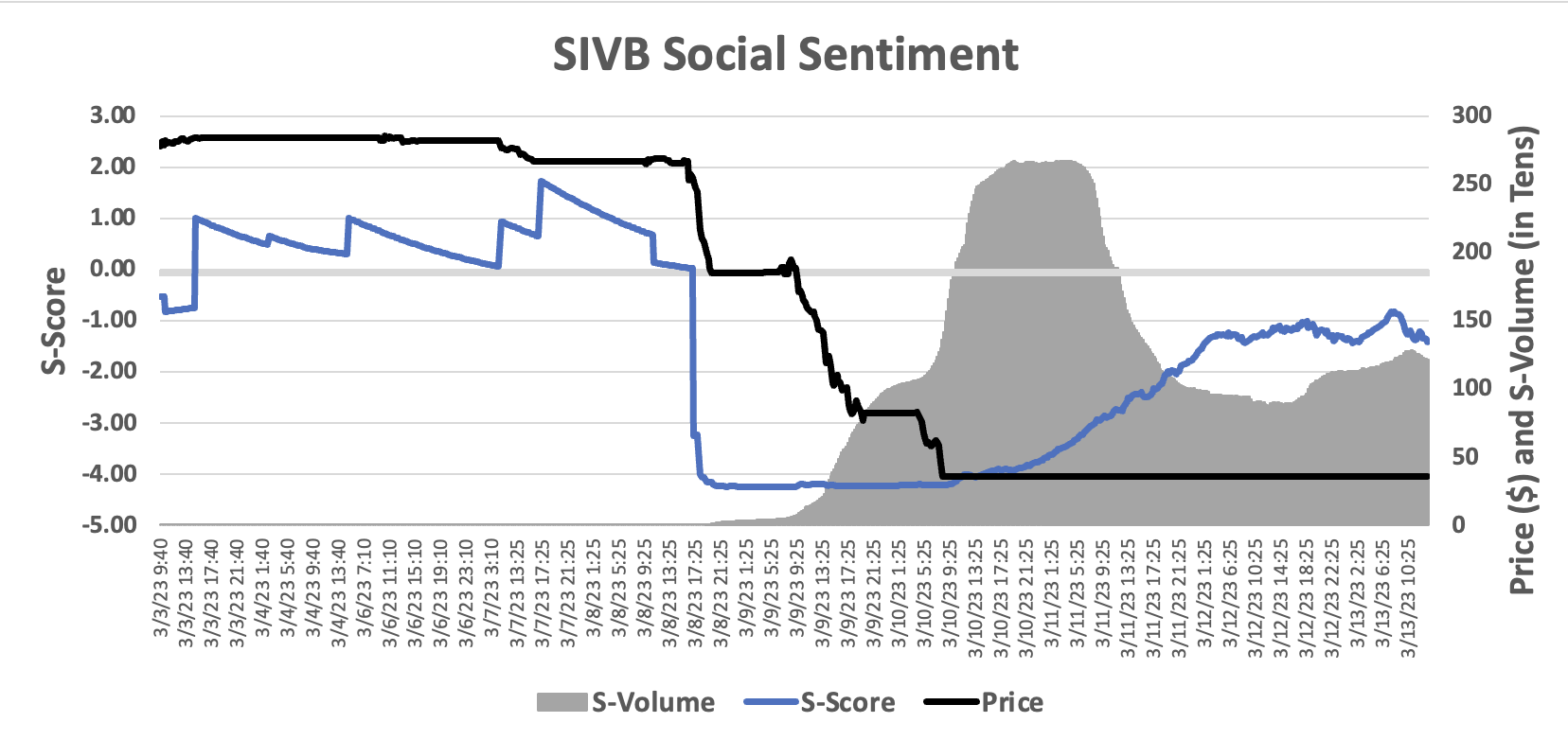

Below is a graph demonstrating how Social Sentiment (Context Analytics’ S-Score, blue line) and Twitter Volume (Context Analytics’ S-Volume, gray bars) relate to SIVB’s price (black line).

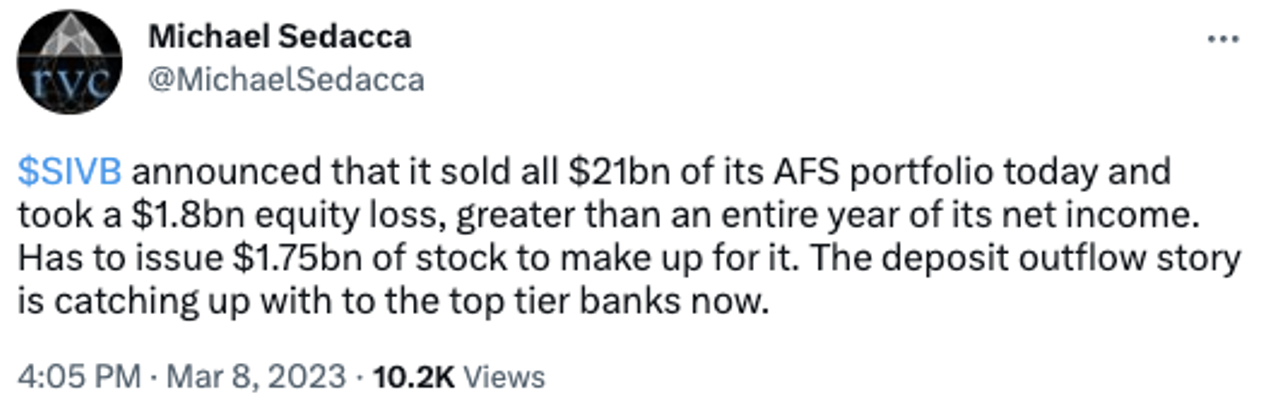

Throughout the market day on March 8th, SIVB had 2 or less Tweets from Context Analytics’ certified Twitter accounts. The S-Score was neutral (between -1 and 1) during market hours on March 8th, however plummeted to extremely negative sentiment after market close. Below is the first negative Tweet received which caused the S-Score to fall.

This Tweet was scored extremely negative, and compared to SIVB’s historical baseline was statistically significant. At this time, SIVB’s stock was priced at $255.

Throughout after-hours trading, more negative Tweets on SIVB were ingested and the stock price kept falling. By the end of the night, SIVB had more Twitter volume than it has ever received before. Previously, the maximum number of Tweets on SIVB in a day was 42 Tweets back in April 2018.

By the next day’s market open, SIVB had over 80 Tweets and was priced at $176.55. As this story hit the mainstream media, Tweet Volume picked up even more and the stock’s price kept falling. Tweet Volume maxed out on Friday, March 10th at over 2,500 Tweets after trading halted in the security.

With Social Sentiment data provided by Context Analytics, users can quickly identify changes in Social Sentiment and Tweet Volume to capture crucial market movements. There are many other applications of using sentiment metrics to improve decision making. For more information, click the button below or email us at ContactUS@ContextAnalytics-AI.com.