Sentiment Weighted Futures Portfolio

Intro: Using Twitter sentiment and volume metrics in the Commodities market can enhance portfolio performance. A sample portfolio using only Context Analytics S-Factors, decreases risk while also outperforming the benchmark 80% over a 7-year period.

Many investors look to Commodities to diversify their portfolio or find alternative leverage in the market. In today’s period of soaring inflation, a trading strategy involving futures could be a valuable hedge. Context Analytics calculates sentiment on over 100 commodities every minute 24/7/365 sing patented Natural Language Processing. The goal of this research is to create a trading strategy using weighted sentiment factors to outperform the general futures market.

For this research, trades are made hourly. Decisions on position weight are updated every hour based on changes in sentiment derived from real time Twitter activity. Unlike equities, the futures market has no baseline index to compare returns. For the purposes of this research the baseline strategy will be an average of every commodity hourly return compounded over testing duration.

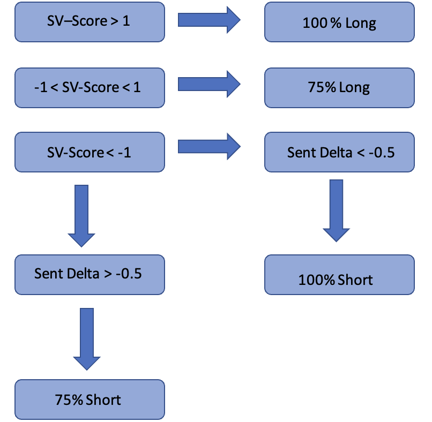

With a formidable baseline to compare, we can now manufacture a strategy using our patented S-Factors. We use a decision tree to adjust position weights. Our strategy will always be in the market and will trade each commodity. The two variables used for decision making are SV-Score and change in sentiment (Sent Delta). The former using standardized tweet volume surrounding the commodity, the latter looking at hourly change in standardized tweet sentiment. Below is the decision tree visualized.

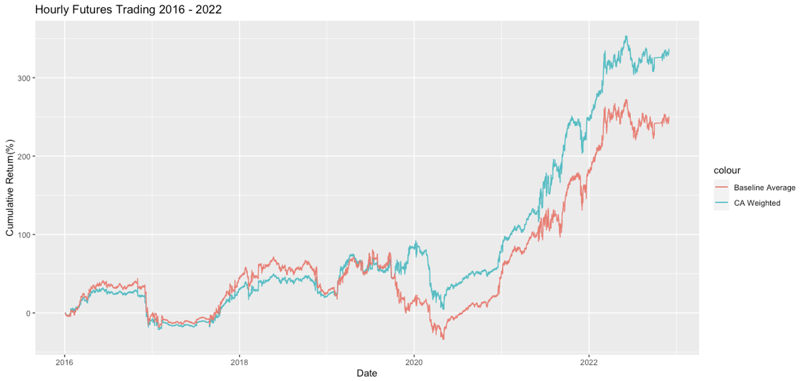

This strategy was back tested starting Jan/2016 and concluded in December 2022. The time series graph shows that Context Analytics’ sentiment improved the baseline average by over 80% cumulatively.

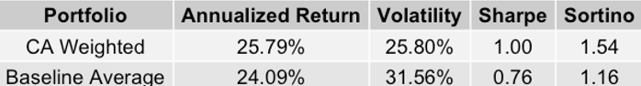

The Context Analytics weighted portfolio improves both Sharpe and Sortino ratios. The annualized return is improved while decreasing volatility. There is sufficient evidence that adding a sentiment weight to the futures market can improve returns in the long run. This is just one example of the many ways to utilize twitter sentiment from Context Analytics to aid trading strategies. For more information, click the link below!