Regulatory Filings on Silicon Valley Bank Collapse

With the collapse of Silicon Valley Bank, Context Analytics wanted to see if there were any warning signs in regulatory documents that could have hinted towards this event. SIVB’s (SVB Financial Group) stock price dropped 34% from market close on Wednesday, March 8th to market open on March 9th and a total of 60% overall.

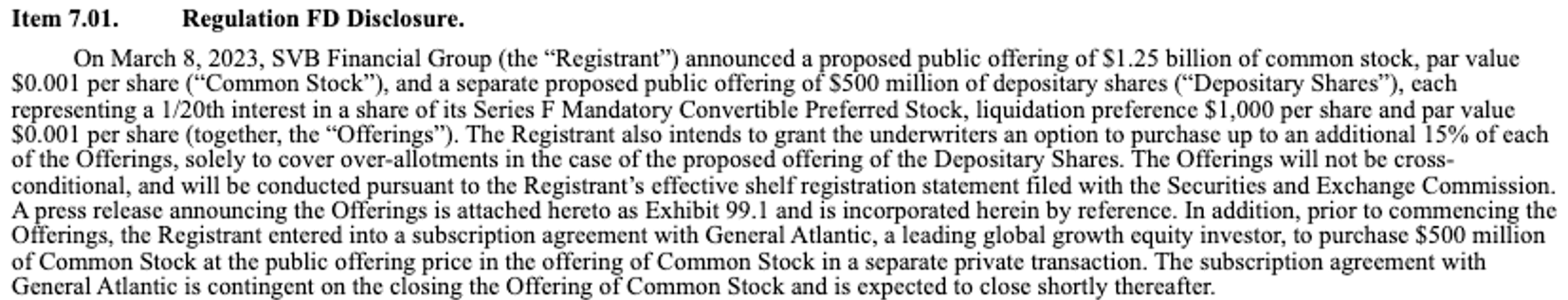

SIVB’s price decreased immediately after market close due to an announcement and SEC filing. They filed an 8-K outlining a planned equity raise which in turn will dilute

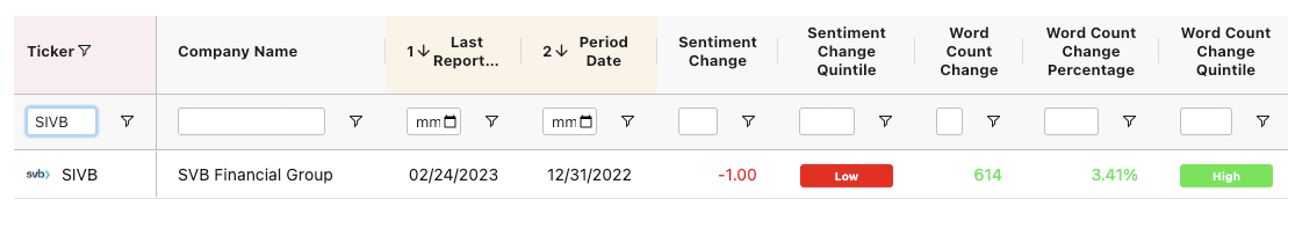

But even before this was announced on March 8th, there were some red flags that popped up in previous regulatory filings. Looking back at SIVB’s most recent 10-K released on February 24th (12 days prior), on Context Analytics’ Unstructured Data Terminal (UDT), you can see an increase in word count paired with a decrease in sentiment in their ‘Risk Factors’ section.

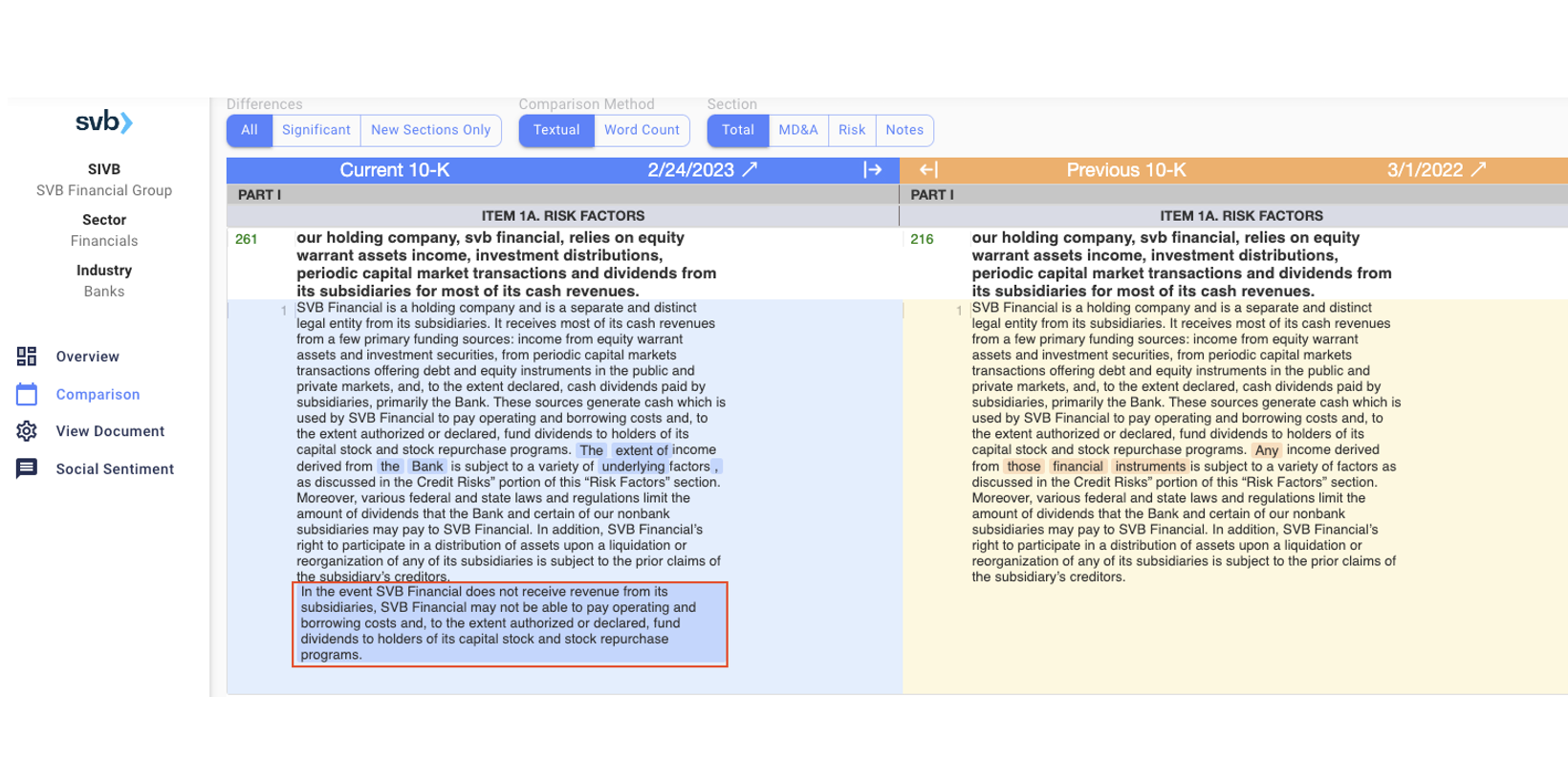

Typically, companies that have large regulatory filings changes tend to underperform the market. If a company is operating at normal, there shouldn’t be any need to change language from its previous report. The companies with instrumental changes need to notify their shareholders through these reports. There were many paragraphs added and reworded in SIVB’s 10-K compared to last year’s filing. Below is an example of a paragraph added to the annual report. Also, the header “Liquidity risk could impair our ability to fund operations and jeopardize our financial condition” was completely rewritten from last year’s 10-K showing the company’s concern with liquidity and changing language to warn investors.

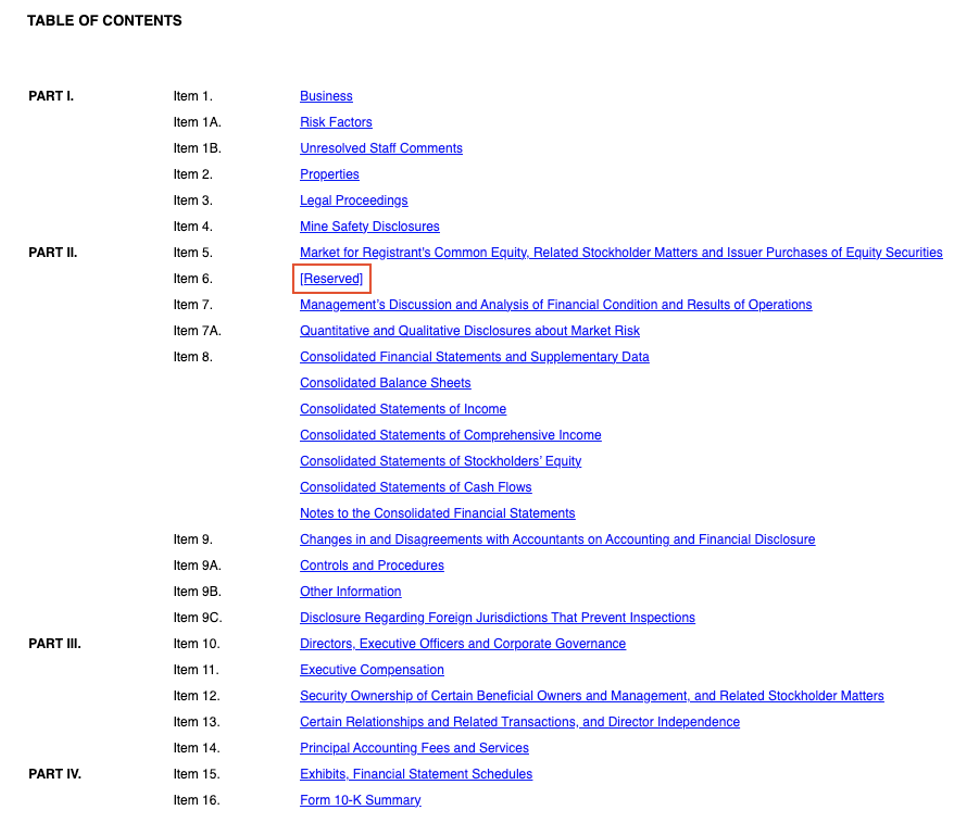

The last red flag on SIVB dates back a few years. Typically, companies report the same financial statements year-over-year accurately reflecting income statements, balance sheets, etc. When companies remove financial information that was previously shared in their annual report, there is cause for concern. Item 6 in a SEC 10-K is ‘Selected Consolidated Financial Data’ which SIVB accurately reports in its 10-Ks released from 2016 to 2021. However in SIVB’s 10-K released on March 1st, 2022, Item 6 had no information and didn’t contain any tables or text. This continued to the new annual report released on February 24th, 2023.

SVB Financial Group had many telltale signs of bankruptcy in their regulatory documents. With many changes to its Risk Factors section paired with not reporting financial information, there was cause for concern in SIVB.

For more information, click the button below or email us at ContactUS@ContextAnalytics-AI.com.