S-Score for Trading Risk

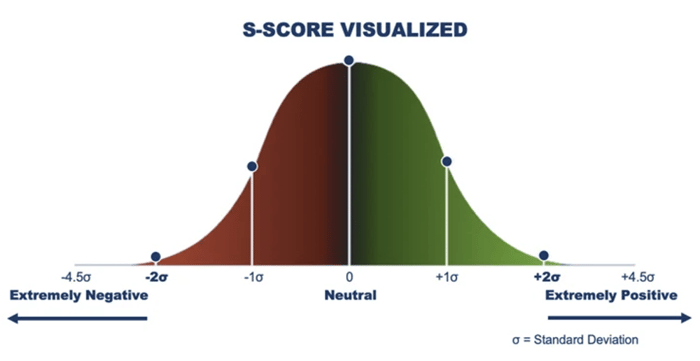

Context Analytics (CA) is the leader in processing and structuring textual data for sentiment analysis. CA ingests data from a variety of sources including Twitter. CA grades the sentiment from Twitter messages on a scale of -1.000 to 1.000, aggregates them over a 24-hour period, and compares it to a historical baseline of 20 days to create S-Factors. The S-Factor feed is one of Context Analytics' longest-running products and includes the S-Score, which is a description of how positive or negative sentiment is by security.

S-Score is calculated by security and gives a cross-sectional view of Social Sentiment without bias towards message volume because the security’s sentiment is being compared to its historical baseline.

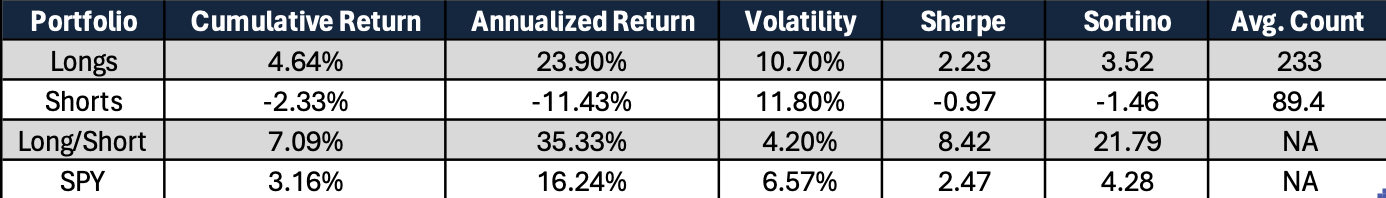

The aim of this blog is to focus on overnight price movements and demonstrate how the S-Score from Context Analytics can assist in managing risk associated with overnight positions. Overnight positions are susceptible to adverse price shifts caused by unforeseen news or events that occur after regular trading hours. Within this blog, we establish a straightforward long/short strategy based on the S-Score obtained at 3:40 PM EST, which is 20 minutes before the market closes. If the S-Score exceeds 2, we initiate a long position; if it falls below -2, we initiate a short position. We hold from the Market Close to the subsequent Market Open and calculate returns, then rebucket daily. The objective is to illustrate the predictive capability of our S-Score concerning overnight price movements. We have implemented this strategy year-to-date and compared our positions to those of the S&P 500 (SPY).

We observe that our Long portfolio has outperformed the SPY by 1.5% this year, while the Short portfolio has underperformed by over 5%, resulting in a negative return for the year. However, when combining the two into a Long/Short portfolio, we see an outperformance of nearly 4%, accompanied by improvements in the Sharpe and Sortino ratios. This suggests compelling evidence of the predictive nature of our S-Score in anticipating overnight price movements.

Such insights could prove invaluable for risk analysts, enabling them to monitor which securities are experiencing negative conversations on Twitter leading up to the market close. For further details on our S-Factor feed, please visit www.contextanalytics-ai.com or reach out to us at ContactUs@contextanalytics-ai.com .