Monthly Portfolio using Twitter S-Buzz

Messages from Twitter provide useful information for security selection. Aggregating these messages and creating social sentiment scores can yield insights. Using Context Analytics Twitter S-Buzz score, customers can create portfolios that outperform the market.

Context Analytics (CA) provides 15+ metrics as part of the standard S-Factor feed. One of those metrics is S-Buzz, a measure of unusual activity on a security compared to the universe of stocks. A higher S-Buzz indicates a security has more messages in the previous 24 hours than it typically does compared to all other stocks.

We created a monthly portfolio that takes the exponentially time-weighted average of S-Buzz over the previous month. This shows which securities over the past month had the most unexpected high message volume on Twitter. It also weights securities with high chatter in recent days more than securities with high chatter earlier in the month. After taking the top 50 securities within the S&P 500 universe with the highest exponentially time-weighted average monthly S-Buzz, we place them in an equally weighted portfolio.

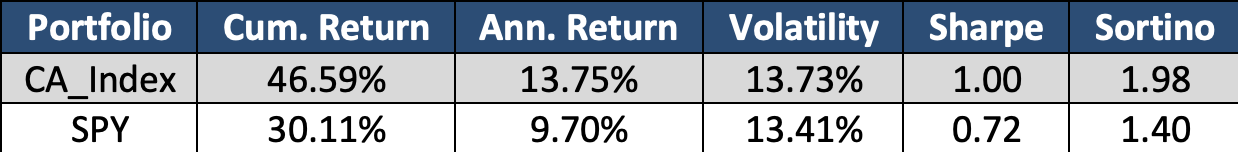

This portfolio of the 50 highest Buzz stocks on Twitter, outperforms the market over the last 3 years. Using 1/10th of the S&P 500’s universe, this portfolio outgains the market 4% annually and over 15% in the last 3 years. The Sharpe and Sortino are also enhanced with the increase in return while nearly having the same risk. By selecting stocks with the highest Social Media buzz, investors can gain hidden alpha.

The portfolio above is one demonstration on how using social sentiment metrics can enhance stock selection leading to higher returns and reduced risk. Context Analytics has numerous sentiment metrics from a variety sources like Twitter, StockTwits, Reddit, and News sites. For more information on Context Analytics, please click the button below or email us at contactus@contextanalytics-ai.com.