Monthly Portfolio using Twitter Raw-S

Intro: Using Social Sentiment from Twitter messages can enhance security selection. Aggregating raw sentiment over monthly periods can be used to create portfolios that outperform industry benchmarks by over 3% annually.

Context Analytics (CA) provides a variety of metrics in the standard S-Factor feed. One of the core metrics is Raw-S, which is a measurement of sentiment from messages in the past 24 hours on a security. Each message is scored from -1.000 to 1.000 and summed by security from messages received in the past 24 hours.

We created a monthly portfolio that takes the exponentially time-weighted average of Raw-S over the previous month. This shows which securities over the past month had the highest or lowest sentiment values from Twitter messages. It also weighs more recent days’ sentiment (Raw-S) more heavily compared to days earlier in the month. After taking the top 200 securities within the S&P 500 universe with the highest exponentially time-weighted average monthly Raw-S, we place them in a portfolio weighted by market cap. Securities are selected at the end of each month based on weighted monthly Raw-S and portfolio adjustments are made at market close of the 4th trading day in the following month.

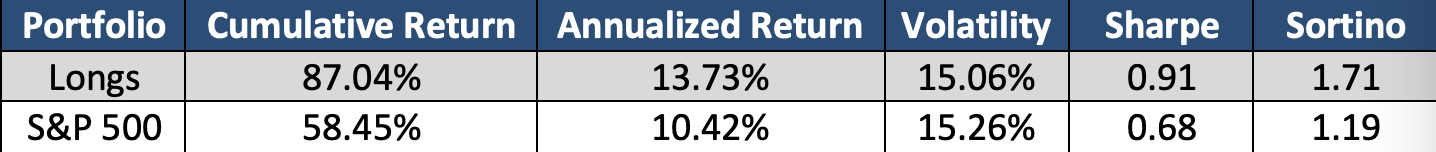

The market cap weighted portfolio of 200 stocks, outperforms the market over the previous 5 years. This portfolio contains 2/5th of the S&P 500 each month and outperforms the benchmark by over 3% annually and nearly 30% cumulatively. The portfolio’s Sharpe and Sortino ratios are above the benchmark while its volatility is slightly reduced. By selecting stocks with the highest Social Media aggregate sentiment, investors can find undiscovered alpha.

The portfolio above is one demonstration of how using social sentiment metrics can enhance stock selection leading to higher returns and reduced risk. Context Analytics has numerous sentiment metrics from a variety of sources like Twitter, StockTwits, Reddit, and News sites. For more information on Context Analytics, please click the button below or email us at contactus@contextanalytics-ai.com.