Evaluating Extreme News on Stock Returns: Positive & Negative Effects

At Context Analytics, we're at the forefront of enriching investment strategies through the integration of alternative data sources. Our latest product, the Quantitative News Feed, which debuted in February, ingests news articles in real-time from thousands of distinct sources. Leveraging proprietary natural language processing (NLP) technology, we analyze and score these articles, producing invaluable sentiment metrics useful for trading decisions.

While our news feed encompasses over 4,000 unique companies, for this research, we narrowed our focus to S&P 500 companies. Our objective was to examine the impact of extreme news days on the stock market.

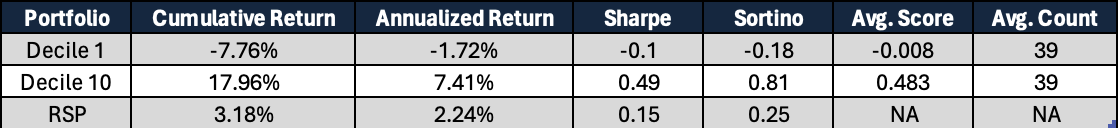

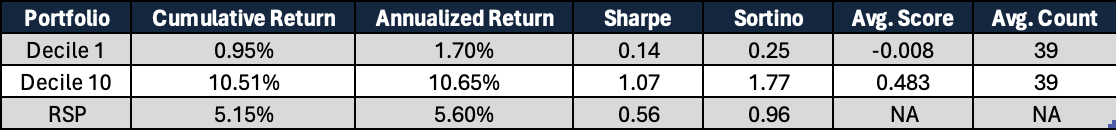

To accomplish this, we calculated an aggregate raw news score for each company within the preceding 24 hours, utilizing metrics gathered from our quantitative news feed. Every morning before the market open, we categorized the S&P 500 companies into deciles according to their raw news score. On average, data is published on 390 of the 500 S&P companies daily. Each decile represents 10% of the total sample, and companies within each decile are averaged equally. The top decile (Decile 10) consists of companies receiving the most extreme positive mentions in the news, while the bottom decile (Decile 1) comprises those with the most extreme negative sentiment. We took these two deciles and calculated subsequent open-to-close returns daily and rebucketed the deciles each morning and compared them to the equally weighted S&P 500 (RSP) as the baseline.

Since August 2021, the top decile consistently outperforms the equally weighted S&P 500 index by a significant 15%. Conversely, the bottom decile underperforms by 10%, with a negative cumulative return over the same period.

This pattern holds true even when examining the rolling one-year history. Regardless of market conditions, extreme sentiment news days continue to demonstrate their influence on stock performance. Positive news days tend to lead to excess returns, while negative days result in underperformance compared to the broader market. These findings underscore the importance of incorporating quantitative news analysis into investment strategies. By leveraging real-time sentiment data, investors can gain a competitive edge and make more informed decisions

To learn more about their quantitative news feed and how it can enhance your investment approach, visit www.contextanalytics-ai.com or click the button below!