Enhancing Trading Strategies with Stocktwits Data: A Bayesian Approach

In the financial landscape, access to timely and reliable market sentiment is invaluable for traders and investors. Stocktwits, a social media platform dedicated to facilitating discussions among traders, has emerged as a significant source of real-time market insights. With millions of active users, Stocktwits offers a diverse pool of perspectives on companies, trends, and market movements.

At Context Analytics, we understand the importance of leveraging Stocktwits data to enhance trading strategies. Through our partnership with Stocktwits, we utilize proprietary natural language processing (NLP) techniques to extract actionable insights from the platform's wealth of user-generated content. We provide traders and investors with data-driven tools and strategies that leverage the information available on Stocktwits.

One of our oldest strategies, the S-Score > 2 Long Strategy, identifies stocks with extremely positive sentiment scores on Stocktwits, enabling traders to capitalize on potential opportunities. For more background information check out our past blogs on Stocktwits sentiment: 2023 StockTwits S-Score Open-to-Close Quintiles

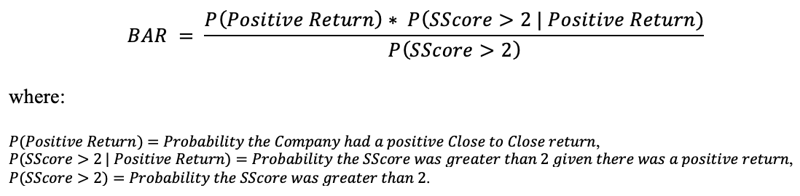

To add another dimension to our approach, we introduced the Bayesian Accuracy Rating (BAR) —a metric that evaluates the probability of accuracy for each company based on historical sentiment data from Stocktwits. By incorporating this rating into our trading strategies, we aim to focus on stocks with a higher likelihood of positive returns, thereby improving the probability of success in trades. The formula for this rating is defined as the following (we used a rolling 252 market day lookback to approximate individual stocks’ probabilities):

This Bayesian approach allows us to continually update our beliefs about which stocks have the most accurate conversation about them on Stocktwits. This calculates the probability of a positive return given the S-Score is greater than 2.

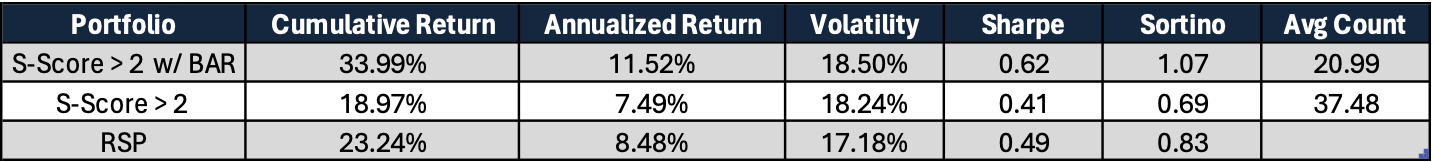

To specifically assess the influence of the BAR, we implemented a filter on the Long Strategy with an S-Score greater than 2. This involved establishing a theoretical Long Position in companies meeting both criteria: having an S-Score exceeding 2 and a BAR surpassing 50%. Our analysis comprised of backtesting three portfolios over the preceding three trading years:

- A Long Position based solely on S-Scores exceeding 2.

- A Long Position accounting for companies meeting the criteria of both S-Scores surpassing 2 and BAR exceeding 50%.

- The RSP (Equally Weighted S&P 500 Index).

We exclusively backtested S&P 500 constituents, ensuring a direct apples-to-apples comparison with the RSP index. This approach allowed us to distinctly isolate the impact of our sentiment and BAR factors since both were applied within the same group of securities. These portfolios are equally weighted amongst constituents and rebalanced daily at market close.

We observed that the S-Score strategy slightly underperformed the RSP, primarily due to a recent unfavorable stretch compared to its historical outperformance. However, there was a significant enhancement when integrating the Bayesian Accuracy Rating with the S-Score strategy for S&P 500 constituents. This improvement amounted to over 4% annually and 15% cumulatively compared to the standard S-Score strategy, while also surpassing the RSP by over 3% annually and 10% cumulatively. Furthermore, this integration resulted in improved Sharpe and Sortino ratios, enhancing risk assessment metrics. When including the Bayesian Accuracy Rating, the average daily security count is 21, a decrease of 44% compared to the S-Score > 2 portfolio. Thus, our findings suggest there is value in incorporating the BAR to gauge the accuracy of discussions surrounding securities on Stocktwits over the preceding year. This case serves as just one of many examples illustrating how our Stocktwits data can be effectively leveraged with various techniques.

For further details regarding our Stockwits data feed or Context Analytics in general, click the button below or reach out to us via email at ContactUs@contextanalytics-ai.com.