Enhancing Momentum Trading with StockTwits Sentiment and Volume

StockTwits is a social media platform primarily focused on financial discussions and market-related topics. As a social media platform focused on investing and trading discussions, it provides a wealth of user-generated content expressing opinions, emotions, and sentiments related to various stocks and assets. By analyzing the messages and interactions on Stocktwits, sentiment analysis tools can gauge the overall mood and sentiment surrounding specific stocks or financial instruments. This information can be valuable for traders and investors seeking to understand market trends, shifts in sentiment, and potential market reactions.

Context Analytics takes sentiment analysis to the next level by using patented NLP algorithms to pull and score messages from Stocktwits in real time. The technology can aggregate raw factors to determine how individual companies are trending over larger periods. For this research, weekly data was used to calculate scores for sentiment and volume. For each market day, the previous 5 market days sentiment and volume was aggregated and standardized over a 2-week baseline. This allows us to identify stocks that were discussed heavily on the platform the week leading up to entering. The sentiment score (Sscore) expresses the standardized raw sentiment over the previous week, while the volume score (Vscore) expresses the standardized volume of tweets. We then decided to add these scores together to create a Sum metric. A high Sum metric include stocks that are discussed not only positively, but in high volume. The metric was calculated as follows:

![]()

A mean reversion strategy in trading works off the theory that stocks will return to their average price following an unusual dip or spike. For the purposes of this research, we investigated stocks that performed negatively over the previous week. A reversion to the mean would expect these to rise back to their average price the subsequent week. To enhance the probability of reversion we identify stocks with a Sum metric that contradicts the previous weeks returns. A large Sum metric as defined above indicates a high volume of positive conversation surrounding a stock. Thus, we expect the negative momentum stocks subsequent price movement to reflect this.

To test this, we created a weekly Close to Close strategy that enters/exits on the last market day of each week. The momentum is defined as the previous weeks close to the entry close. The Sum score calculated above is calculated for 20 minutes prior to the entry position. So, each week we rebucket our portfolio based on the momentum and Sum Score. We select the top Sum score stocks that had negative momentum leading to the entry. This allows us to maintain a position with exclusively ‘hot’ topics on Stocktwits that we predict will revert to the mean in the subsequent week. For liquidity and a reduction of volatility, we only selected stocks that are within the S&P 500 universe. To compare performance, we graphed the weekly returns of the Top 20 stocks matching the criteria to SPY. We back tested from the beginning of 2012 to July of 2023.

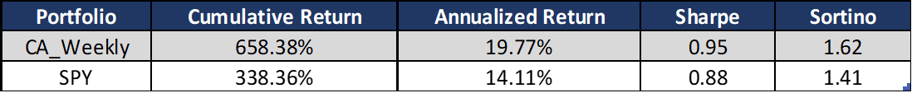

This strategy performs very well over the full history. The annualized return of the SPY is improved by over 5.5% while selecting stocks the index tracks. The cumulative return is raised by 320% over this 11-year period. The Sharpe and Sortino also indicate a lower risk portfolio than the popular SPY index. We then investigated a more recent history to see how the strategy has performed of late.

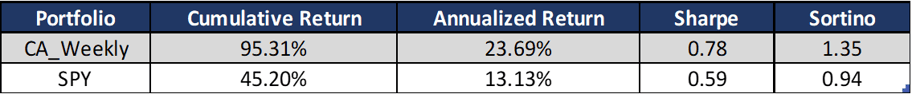

Over the past 3.5 years, the strategy has performed very well. It brings a 10% higher annual return than the SPY, while resulting in a 50% larger cumulative return. The risk ratios again indicate an improved portfolio.

Reversion to the mean is a common statistical occurrence. With StockTwits sentiment and volume, however, we obtain better predictors of when this reversion will occur. This research shows that StockTwits sentiment is not only predictive by itself but can be used to enhance other trading strategies. For more information on StockTwits sentiment data visit our website contextanalytics-ai.com or email us at ContactUs@contextanalytics-ai.com.