Daily Twitter Sentiment: A Comparison of Universe Performance

In this brief analysis we expand on our previous blog. We compared how SMA’s longest running trading strategy performs on sentiment metrics derived off Twitter vs StockTwits. Now we look at how this strategy on Twitter compares across different universes.

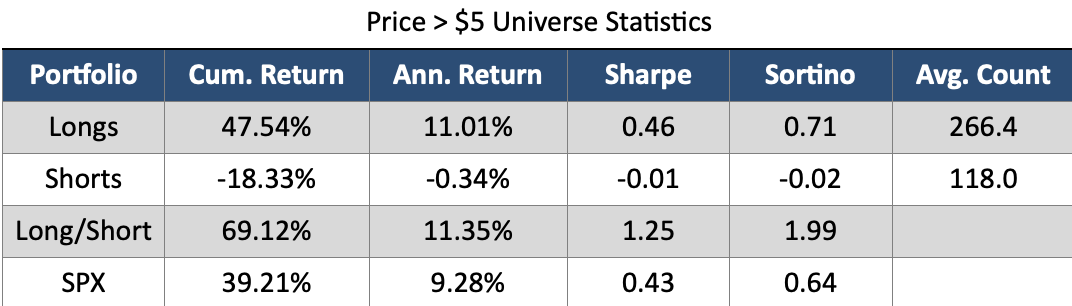

SMA’s Price > $5 Universe includes all SMA covered securities with a previous Market Close Price > $5. This excludes micro-cap stocks with high price volatility and liquidity concerns. The number of securities in the universe fluctuates each day but is approximately 4,000 securities per day.

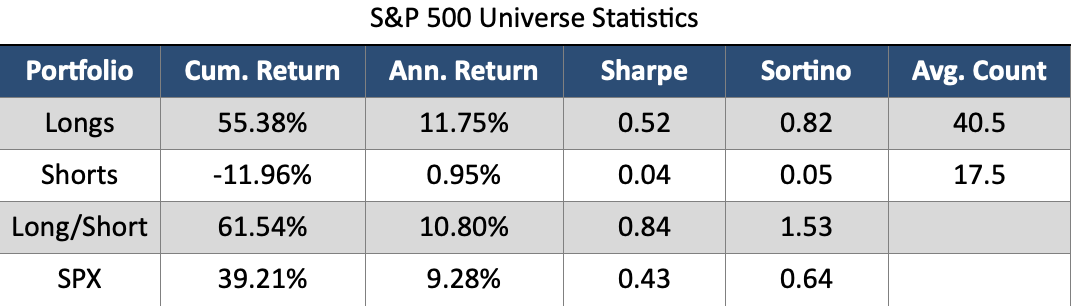

The S&P 500 Universe only includes index constituents. Because the universe size is smaller than SMA’s Price > $5 Universe, we expect fewer daily signals. Below are the strategy performances for both Universes. Please note that negative return on the short side indicates positive alpha. Returns are calculated from 2018 to current.

The similarities in plots demonstrate how the S-Score is conducive across different market cap regimes for daily trading. While the S&P 500 Universe produced a more robust Long Only strategy, the Universe with 4,000+ securities outperform on the short side. There is more risk associated with smaller cap companies, and negative sentiment can impact a security’s price more than larger companies with big brands.

In both universes, the Long Only and Long/Short portfolios outperform the market while mitigating risk over a period of nearly 5 years. A Macro-Cap strategy on the S&P 500 Universe can be executed with an average of 58 trades each day. Sentiment on a universe of all stocks can spark trade ideas in new securities or emerging industries.

The graphs above demonstrate the robustness of SMA’s S-Score. On both the Long and Short side, and across different Market Cap regimes, the S-Score can provide additional information to your trading strategy.

If you are interested in learning more about SMA’s offerings, please visit our website or email us at contactus@socialmarketanalytics.com.