Daily Open-to-Close Long/Short Strategy : Raw-S

Context Analytics has a variety metrics derived from Social Media feeds such as Twitter and StockTwits. Here we look at the simplest and most raw sentiment factor: Raw-S. Recently, Raw-S has been highly predictive of market returns at the Open. This Daily strategy using only S&P 500 stocks yields a Long/Short that has outperformed SPY by 30% since 2022.

This blog explores Context Analytics’ Social Media Sentiment Feed, and how it could be used for day trading. Like previous blogs, we explore a specific factor to see how it can be insightful for future stock returns. Raw-S, also known as Raw Sentiment, is the sum of Tweets’ sentiment score on a topic from the past 24 hours. Each Tweet is scored from a range of -1.000 to 1.000, with very few Tweets reaching extreme values. The more Tweets on a topic, the more likely the magnitude of Raw-S (either positive or negative) is larger.

Raw-S is the basis of many other factors provided in the S-Factor feed and is a fundamental data field. `S` is the exponentially time-weighted factor of `Raw-S` and `S-Score` is derived from `S`. Using this unweighted raw sentiment field helps a trader understand which stocks are most popular and the direction of that popularity (positive or negative sentiment).

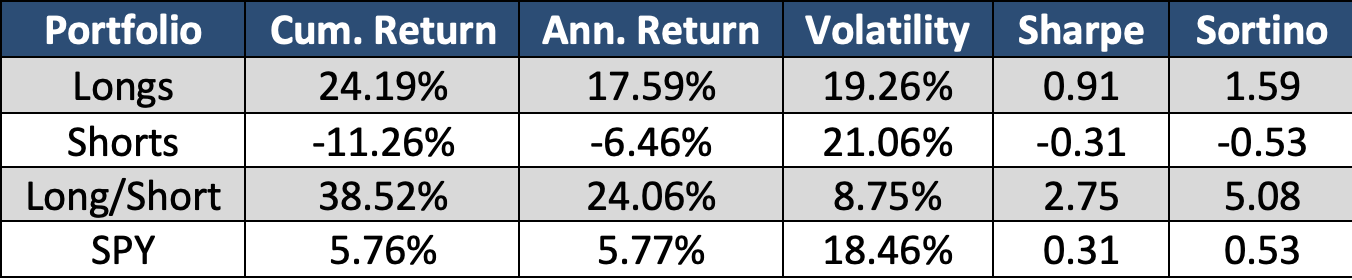

In the analysis below we use Raw-S values of each S&P 500 constituent before market open (9:10am ET) each day. The stocks with the top 50 Raw-S values are placed in the ‘Longs’ bucket while the bottom 50 securities are placed in the ‘Shorts’ bucket. We take the subsequent Market Open to Market Close return of each security and take the average return within each portfolio. Each security has an equal weight in the ‘Longs’ and ‘Shorts’ portfolio. The ’Long/Short’ portfolio is an equally weighted between the ‘Longs’ and ‘Shorts’.

The graph above demonstrates securities with higher Raw-S values at market open outperform the benchmark while securities with the lowest Raw-S values underperform. This principle applies to securities across market caps and industries in the US Equities universe. The Long side has an average turnover rate of 58% and the short side’s rate is at 79%. Ideally, this strategy is used as a Long/Short to mitigate risk and volatility, however a Longs only strategy since 2022 significantly outperforms the market with a substantially higher Sharpe ratio too.

Raw-S is one of many factors provided by Context Analytics through the S-Factor feed. It is typically used as the most granular piece of information when aggregating and creating sentiment metrics. However, the factor itself has proved to be highly predictive of daily price returns. For more information about Context Analytics, click the button below or email us at ContactUS@ContextAnalytics-AI.com.