Crypto Daily S-Score

As traditional markets like equities continue to be influenced by various factors, crypto markets have risen as an intriguing alternative, touted by many as a hedge against stock market volatility. When traditional markets experience downturns, cryptocurrencies have, on occasion, demonstrated resilience or even appreciation. This unique behavior has piqued the interest of investors.

Natural Language Processing (NLP) from Context Analytics allows us to minutely gauge sentiment for each of the 746 active cryptocurrencies we cover. The analysis involves capturing sentiment data at a specific timestamp (23:55 UTC) and tracking subsequent daily returns for each coin.

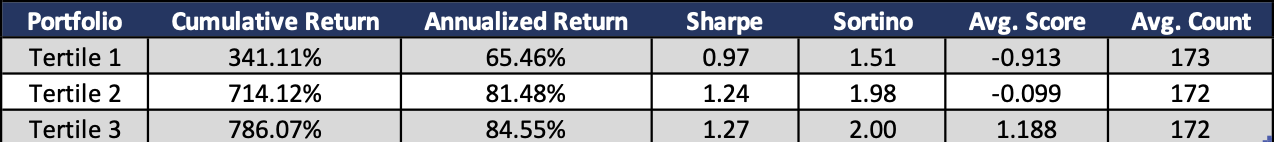

For this study, we began by categorizing the coins into tertiles based on their S-Scores at the 23:55 UTC timestamp. The bottom 33% S-Scores are placed into Tertile 1, next 33% into Tertile 2, and top 33% into Tertile 3. The S-Score is an indicator of standardized sentiment over the previous 24 hours compared to a 20-day baseline. Next, we calculated daily returns covering the entire universe since the start of 2021 for each tertile.

There is a clear correlation between the tertiles and subsequent returns that emerges. The bottom tertile consistently underperforms the other tertiles, suggesting a link between negative sentiment and reduced performance. The Cumulative Return, Annualized Return, Sharpe Ratio, and Sortino Ratio all increase with an increase in Tertile.

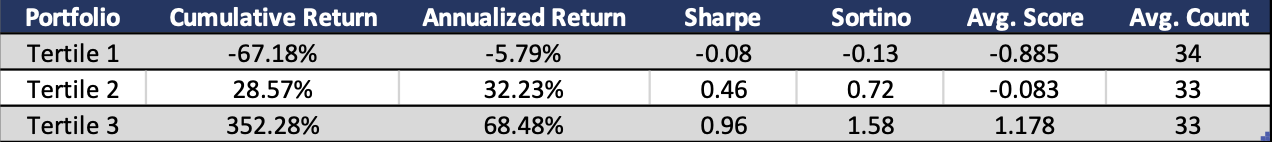

Next, we focused on the top 100 market capitalization coins. These are coins most prevalent in daily and intraday crypto trading.

We see the effect of tertiles enhanced. In fact, the bottom tertile produced negative returns over the trading history. The middle tertile stays close to even, while the top tertile significantly outperforms the others. This shows that the correlation could be even stronger for the larger cryptocurrencies.

This research underscores the potential role of Context Analytics in Crypto trading. As the cryptocurrency market matures, Context Analytics provides a way for traders to harness sentiment and make well-informed decisions, ultimately enhancing their success in this domain. For more information on sentiment data from Context Analytics, visit our website www.contextanalytics-ai.com or click the button below!