CAPE Provides a Significant Advantage for VC firms

Venture Capital firms, on average, receive between 4,000 to 5,000 separate pitch decks from hopeful investees. These pitch decks are crucial as they contain financial information that tells a compelling story about each company and provides key insights for assessing their investment worth. However, extracting specific metrics efficiently from this massive volume of documents and making meaningful comparisons can be a challenging task. Currently, this process relies on manual efforts to search for relevant data and compile data series from the raw documents into a central location. This manual approach poses significant challenges in extracting and organizing data from various formats, making it extremely difficult to perform accurate comparisons among the different pitches.

Context Analytics Pitchdeck Extractor (CAPE) turns these financial documents into machine-readable data. CAPE processes entire libraries of documents and converts it to a standardized Excel, CSV, or Snowflake format in just a few hours. CAPE provides a significant advantage for VC firms dealing with extensive pitchdeck volumes. Its versatility navigates through hundreds of different formats, extracting data from hidden rows/columns, distinguishing between forecasted and historical data, and recognizing various unit multipliers, date formats, and more. CAPE simplifies the data extraction process, streamlining workflow and ensuring accurate analysis.

After the swift parsing process, CAPE consolidates all the gathered data into a standardized dataset. This uniform format ensures the data's consistency, accuracy, and reliability. Moreover, it facilitates effortless comparisons between different. Being machine-readable, this standardized format allows seamless data exchange and comprehension across various systems, thereby streamlining the data analysis process.

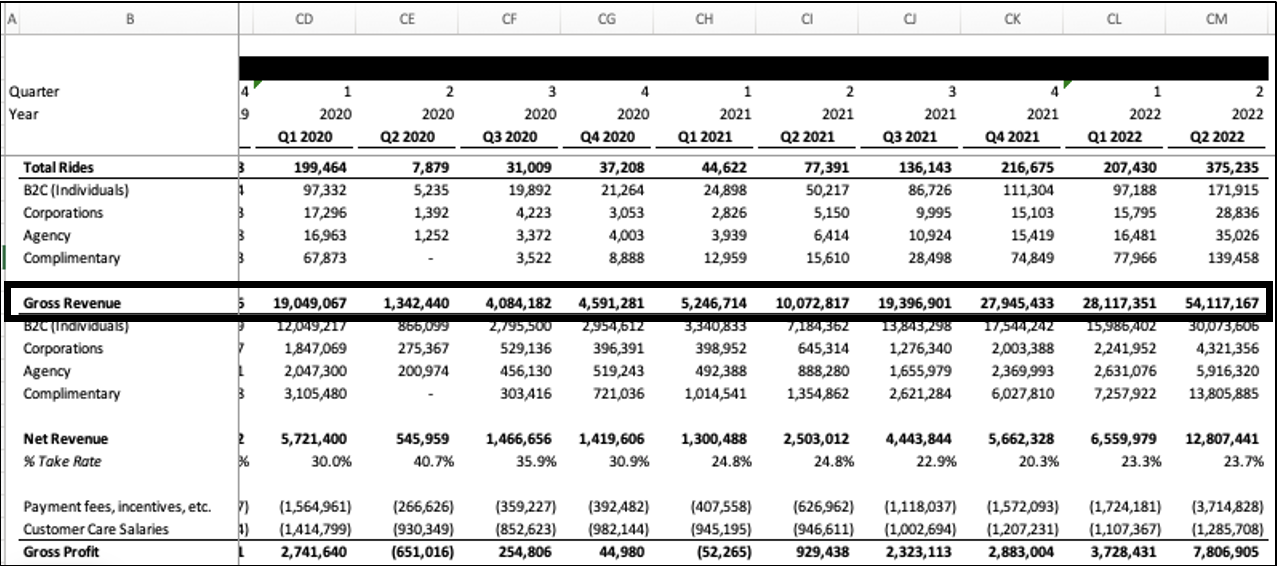

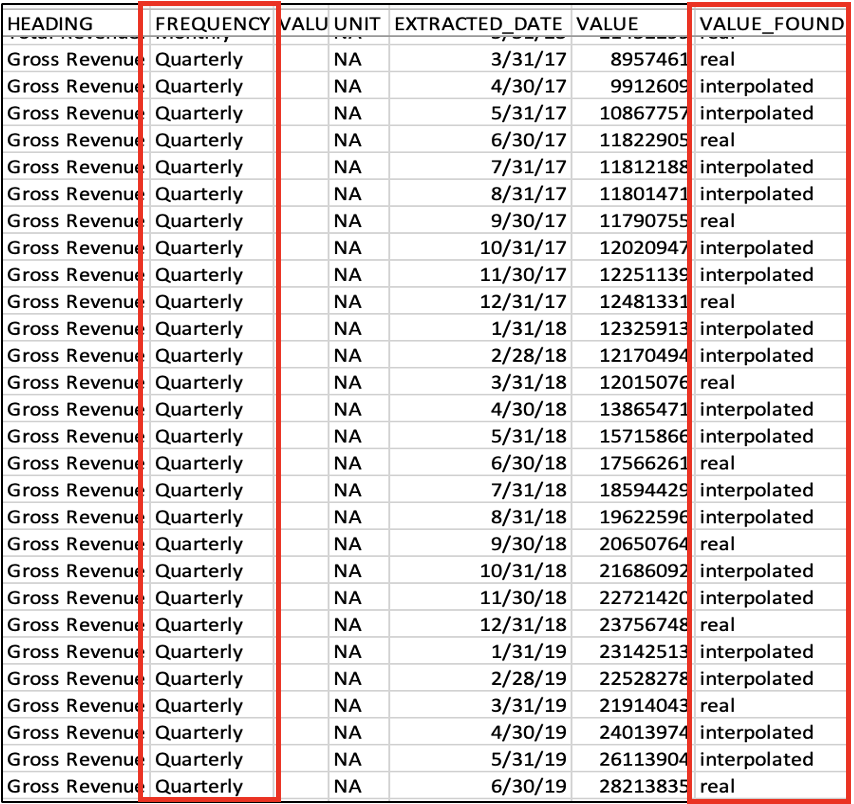

Another valuable feature of CAPE is its ability to interpolate data points upon request. Often, companies report financial data at different levels, such as monthly, quarterly, or yearly. When only one level of information is available, it becomes challenging to compare on the same scale. However, CAPE overcomes this obstacle by interpolating quarterly and yearly data to monthly. This ensures a more comprehensive view of the financial performance, making it easier to conduct meaningful comparisons and draw insights. An example of CAPE's interpolation capability is shown below when it extracts quarterly gross revenue from an Excel sheet and then accurately fills in the months between quarters with interpolated monthly gross revenue.

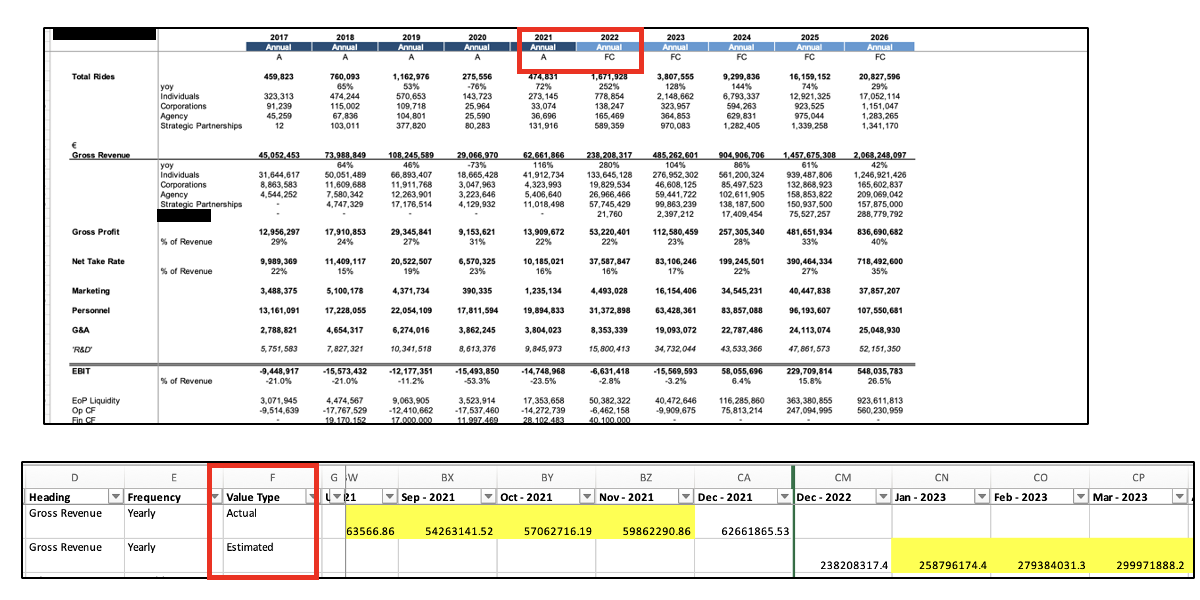

CAPE is customizable to customer preferences. For instance, it can be employed to extract data exclusively related to Top-Line Revenue. With this objective, CAPE will sift through the provided decks and retrieve only the information that is directly associated with revenue. CAPE can then incorporate a Top-Line Identification feature to filter numerous financial series for each company that falls under the revenue category. CAPE utilizes learned filters to eliminate irrelevant headings, sheets, or documents and ultimately selects a summarizing series that pertains directly to the company's revenue. By implementing this approach, CAPE streamlines the extraction process, ensures accuracy, and facilitates the smooth flow of analysis.

The distinction between Historical and Forecast data is crucial when comparing companies at the same level. CAPE's training on a vast array of formats empowers it to identify forecasted data even when encountered in previously unseen samples. For instance, in the provided example, the data sheet subtly switches its tag from 'A' (representing Actual/Historical data) to 'FC' (indicating Forecasted data). CAPE promptly recognizes this alteration and accurately tags the corresponding data accordingly. This capability ensures that investors and analysts can rely on CAPE to effectively distinguish between Historical and Forecast data.

CAPE serves as a powerful tool that transforms financial pitch decks into easily machine-readable data. Through standardization and centralization, CAPE enables swift analysis, allowing investors to dedicate more time to identifying promising investment opportunities. Currently, CAPE specializes in extracting revenue data, but its adaptable nature means that the same process can be tailored to extract other requested metrics such as expenses, employee data, net income, and more. CAPE is available in Excel, Snowflake, JSON, or any other requested format.

If you are looking to streamline your financial data extraction process, visit our website at ContextAnalytics-AI.com. For inquiries or to get started, click the button below or reach out to us at ContactUS@ContextAnalytics-AI.com.