Cape PDF Extraction Blog

In venture capital and private equity, making quick data-driven decisions is crucial. Access to accurate and relevant financial information is the bedrock upon which these industries thrive. However, the abundance of unstructured data in the form of pitch decks, investor presentations, and various documents can make it challenging to extract and consolidate essential financial metrics. This is where Context Analytics Pitchdeck Extractor (CAPE) steps in.

CAPE is a powerful software application that extracts financial data series from investor data rooms and centralizes them in a standard format. In an environment where thousands of documents are scattered across investor data rooms, CAPE excels in its proprietary processing capabilities to streamline this data.

The key feature highlighted in this blog is the ability to efficiently process PDFs, a common format for pitch decks. PDFs are a challenge for traditional data extraction methods. By navigating these PDF documents, CAPE identifies and extracts financial data series. CAPE transforms them into standardized, easy-to-analyze formats. We will go through 3 separate examples where CAPE pulls financial metrics. For this blog, we outputted to CSV, but the output structure can be tailored to customer needs such as JSON, Snowflake table, etc.

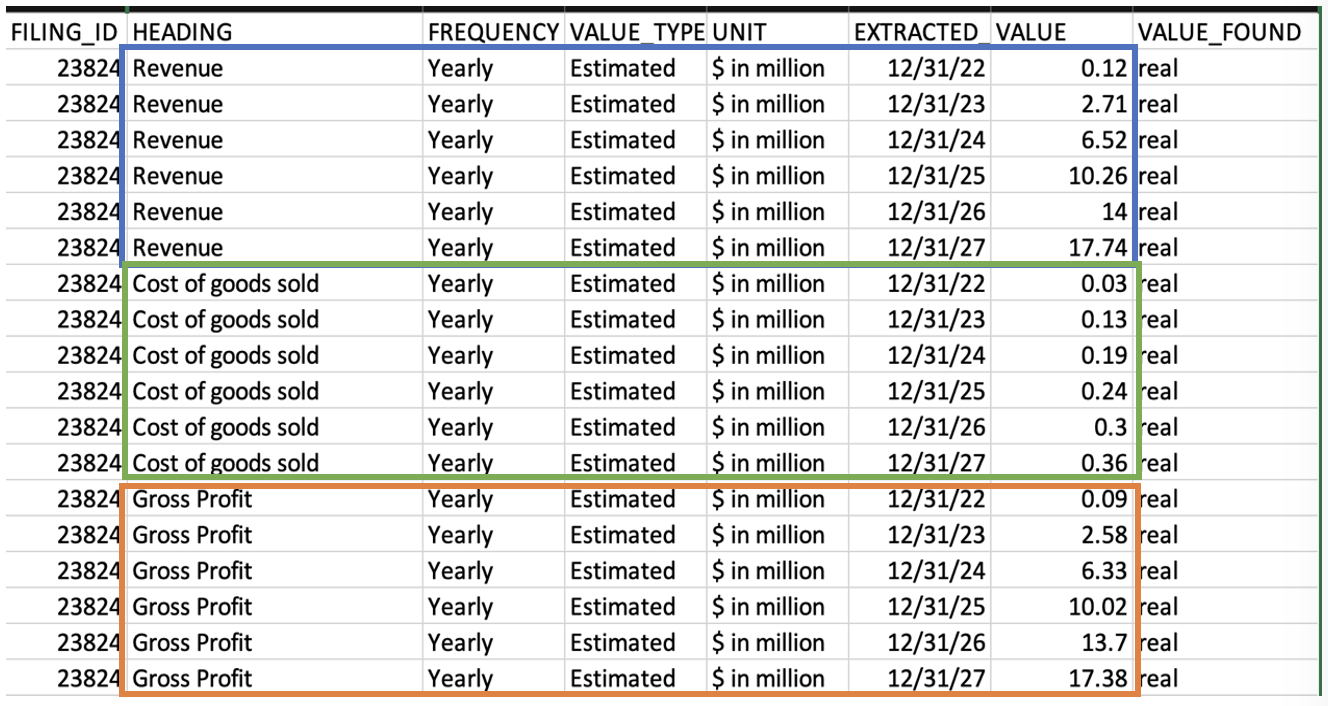

If a company presents its yearly revenue or gross profit in a table format within a pitch deck as shown below, CAPE recognizes the relevant time series and centralizes them into a single output.

Input 1:

Output 1:

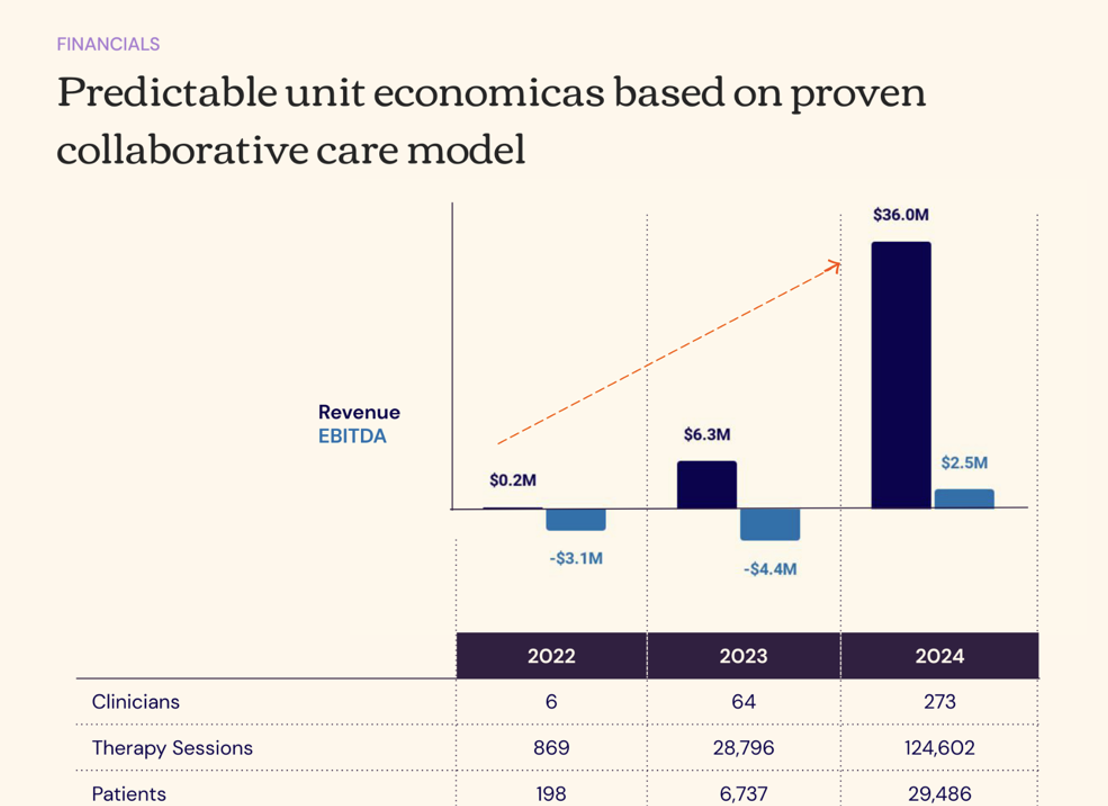

Notice CAPE recognizes the P in the date indicating a projection and labels the data as estimated in the output. In another scenario, financial metrics are presented in charts and graphs. The software is equipped with the intelligence to distinguish relevant metrics and extract the time series, even when they are embedded in visual formats. CAPE also identifies the unit multiplier of Millions and includes it in the output.

Input 2:

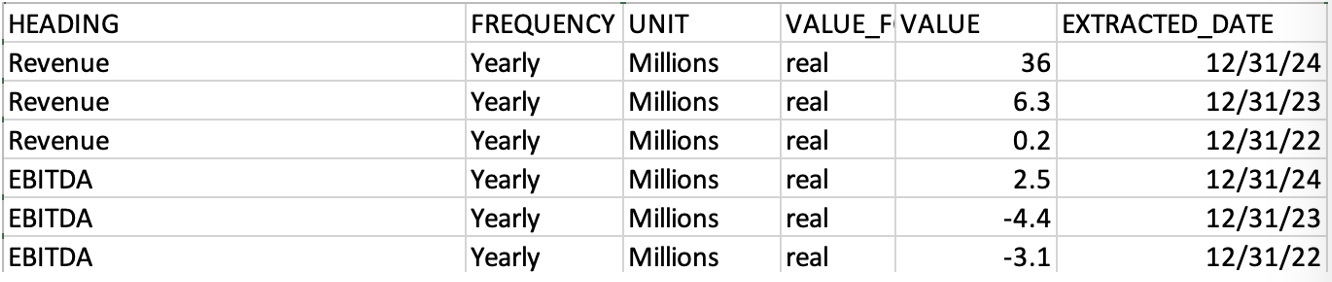

Output 2:

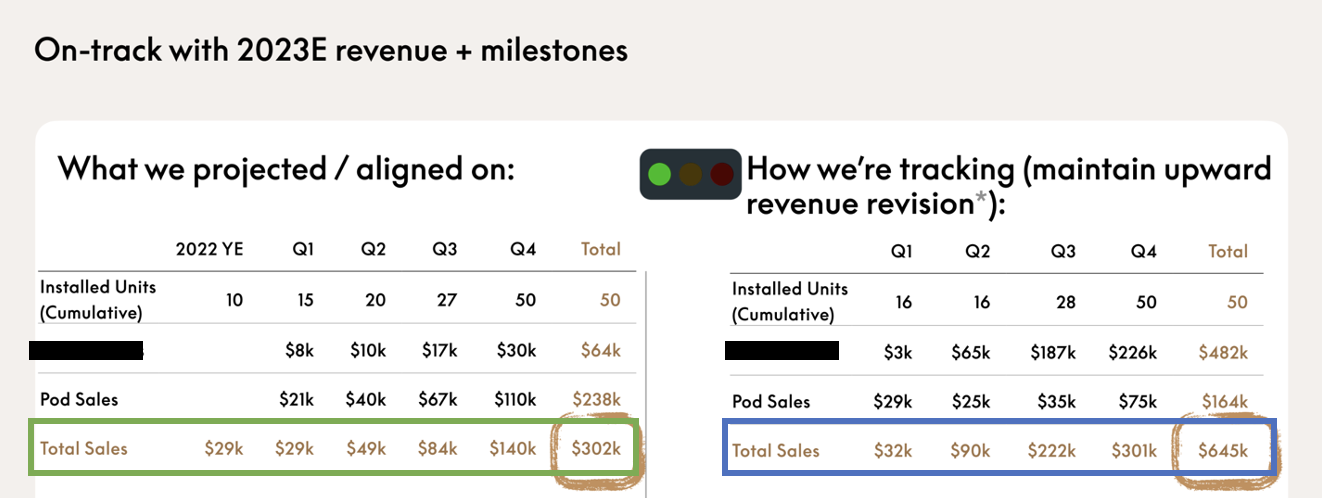

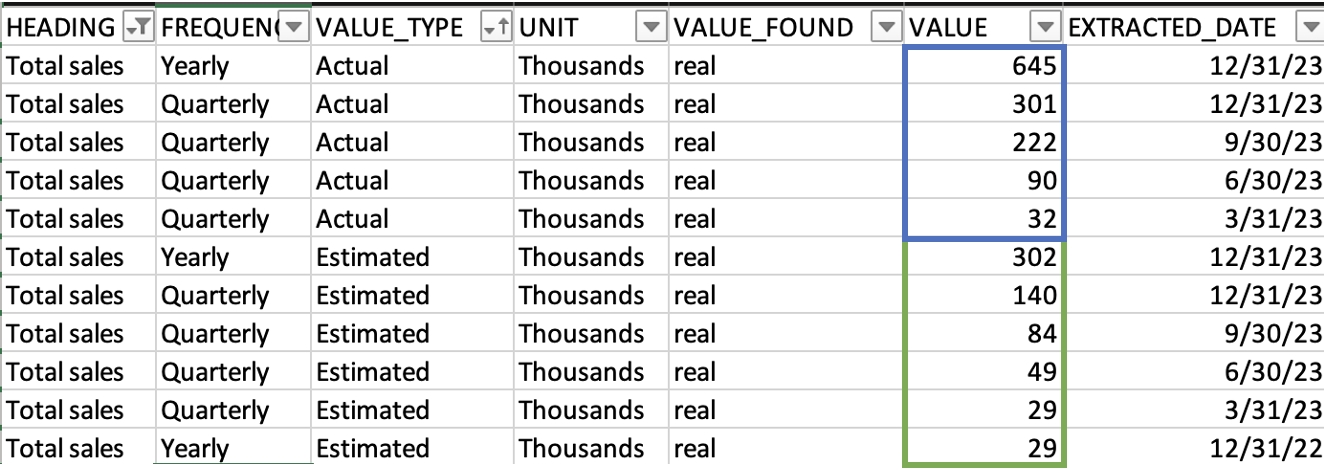

Finally, we get an example where there are multiple tables on one page. One of them represents their projections for the year, while the other shows what they have gained and what they are on pace for. CAPE correctly identifies the left table as the estimated, and the right table as the actual financial metrics.

Input 3:

Output 3:

CAPE parses financial metrics in a wide range of unique PDF formats, these are just three examples among many. When dealing with a large volume of PDFs or PowerPoint slides like these, manually sifting through all these metrics and comparing them can be a time-consuming endeavor. CAPE saves you time so you can spend more time on analysis and move faster than your competitors.

For venture capital and private equity firms, time is of the essence. Traditional methods of data extraction can be both time-consuming and error-prone. CAPE, on the other hand, streamlines this process, making it highly efficient. This allows users to shift their focus towards analyzing the extracted data, rather than getting bogged down with time-consuming data entry and conversion tasks. For additional information about CAPE or to request a trial, contact us via the button below or visit our website at www.contextanalytics-ai.com.