Analyzing Open-to-Close Movement with Standardized News Metrics

In today's information-rich landscape, the abundance of news can overwhelm investors striving to make well-informed decisions in the stock market. At Context Analytics, we've recently launched a quantitative news feed capable of processing thousands of articles in real time. Leveraging proprietary natural language processing technology, we evaluate sentiment on each of these articles. Our previous research has suggested a correlation between news sentiment surrounding companies and price movements. In this blog, we introduce novel standardized metrics designed to serve as a signal for traders.

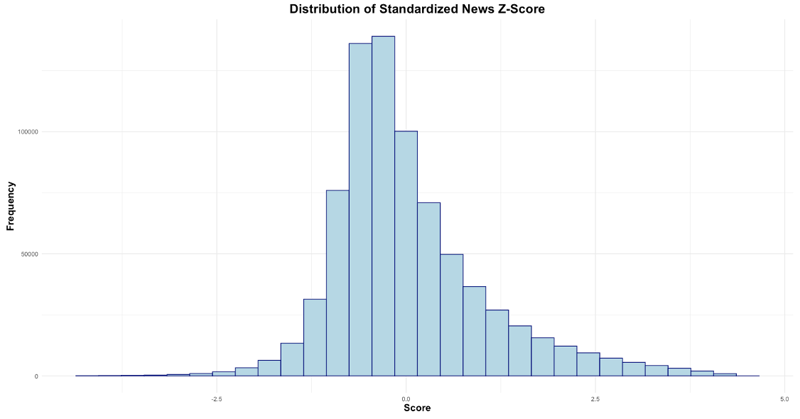

Our approach begins before the market opens at 9:30 am. We aggregate sentiment data from the past 24 hours for each company and establish a baseline by analyzing sentiment over the previous 21 days of news present for each company. Days without news were excluded from this analysis. This allows us to compute a standardized z-score for news sentiment, providing insight into sentiment relative to each company's recent history. The distribution of this News Z-Score is shown below:

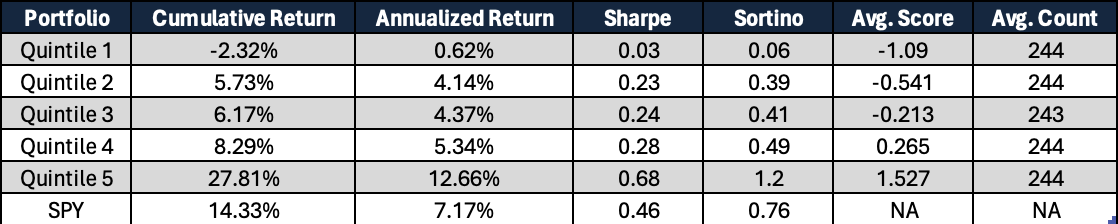

This score exhibits an approximately normal distribution, albeit with a longer tail on the positive side. This distribution suggests that consistent behavior can be anticipated before grouping. Employing our standardized news score, we categorize securities into quintiles according to sentiment. Quintile 5 corresponds to the most positive news sentiment, whereas quintile 1 denotes the most negative sentiment. Subsequently, we monitor the subsequent open-to-close returns, recalibrating daily and compounding returns over the previous 2.5 years. The universe of securities includes any stock with a price greater than $5 on the previous day’s market close.

We observe a notable trend wherein Quintile 5 consistently surpasses the performance of the other quintiles, exhibiting a remarkable cumulative return exceeding 27% over the observed period. By contrast, Quintile 1 demonstrates underperformance, yielding a cumulative return close to -2% within the same timeframe. In comparison, the SPY ETF achieved a cumulative return of 14.33% during this period. Across all quintiles, a clear monotonic relationship emerges, suggesting a predictive correlation between positive sentiment and higher returns, and conversely, negative sentiment and lower returns.

Our findings suggest that news sentiment can offer predictive insights into stock market movements. By leveraging our quantitative news feed, investors gain a valuable tool for navigating market dynamics. For more information on how you can utilize our data, contact us via the button below or visit our website at www.contextanalytics-ai.com.