2022 Review: Context Analytics’ Social Sentiment S-Factor Performance

Context Analytics makes sense of all this news by ingesting Twitter messages on securities and creating sentiment metrics describing the breadth and tone of conversations using proprietary Natural Language Processing.

S-Factors are metrics describing sentiment on financial securities from Twitter messages over the previous 24-hour period. These factors are helpful for predicting security price movement over the next couple days. Users also aggregate these daily S-Factors into longer-term metrics more suitable for trading weekly or monthly holding periods.

This blog will explore different S-Factors and demonstrate how users can extract predictive information from Social Sentiment metrics over different holding periods.

Daily

Context Analytics’ S-Score is one of a variety of metrics in the S-Factor feed. This metric standardizes an exponentially weighted summation of sentiment from Tweets in the past 24 hours and compares it to a historical baseline by security.

The S-Score is a normalized metric like a statistical z-score. A high S-Score indicates Twitter conversation on a security is more positive compared to the security’s historical baseline and is expected to outperform the market. Alternatively, a low S-Score means negative Twitter sentiment with an expectation of underperformance.

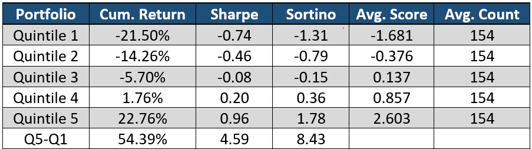

The graph below is a Quintile plot where each day securities are bucketed into 20% bands based on S-Score. Quintile 5 contains the securities with the highest S-Scores and Quintile 1 has securities with the lowest S-Scores each day. The mean daily return is cumulated over time to demonstrate the monotonic nature of the factor.

S-Score is retrieved at 9:10am ET (20 minutes before Market Open) while the daily return is calculated from Market Open to Market Close. The universe of securities selected must have a stock price > $5 and there must be at least 3 Tweets in the previous 24 hours from Context Analytics certified Twitter accounts (S-Volume >= 3) to ensure the validity of the sentiment. On average, there are 770 securities each day that meet these criteria.

There is a clear relationship between S-Score the subsequent Open-to-Close return in the graph above. As S-Score increases, it is more probable the security’s return will outperform the market. Inversely, as the S-Score decrease, it’s expected the stock will underperform.

The average S-Scores of Quintiles 2-4 are fairly neutral due to the normalization of Sentiment. This is as expected, leaving Quintiles 1 and 5 on the extreme ends of the sentiment spectrum with their average S-Score being more than one standard deviation away from Quintiles 2-4. There is a clear spread in average S-Score between Quintiles 5 and 1, so a theoretical Long/Short was created.

The Long/Short is a market neutral strategy. It has an outstanding Sharpe Ratio of 4.59 and a return of over 54% in 2022. This portfolio does not include overnight positions, adding to the risk-adverse nature of the strategy. This demonstrates daily Twitter Sentiment is a critical tool in stock selection and enhancing portfolio returns.

Weekly

There are a variety of ways users can utilize Context Analytics’ S-Factor feed. One way is by retrieving 24-hour metrics from the S-Factor and aggregating them by security to create weekly or monthly metrics. These aggregated metrics are better for trading longer holding periods compared to a 24-hour metric.

In this strategy we decided to use `S`, which is the 24-hour exponentially weighted summation of sentiment. A 5-day rolling summation of `S` is taken by security to see which security had the most positive sentiment on Twitter over the last week. Sentiment data (`S`) is only extracted from trading days, so that’s why a 5-day rolling summation was used instead of 7-days.

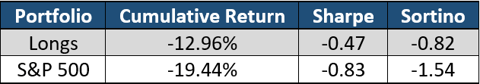

The strategy below is a weekly strategy that rebalances on Market Close of each week’s last market day. A universe of S&P 500 stocks is used while there must be at least 5 Tweets in the 5-day period from Context Analytics certified Twitter accounts.

At the end of each week, the Top 50 stocks with the highest 5-day rolling summation of `S` are selected and equally weighted in the Longs portfolio below.

Although this portfolio did decrease in value, the overall performance compared to the S&P 500 is noteworthy, beating the market by 6.48%. This portfolio had a turnover rate of 53% in 2022, which means roughly half the portfolio’s holdings would stay the same week-over-week.

`S` is one of the more helpful S-Factors used for aggregations over longer periods. It not only is a measurement of sentiment, but Tweet volume also impacts the magnitude of the value. Since it isn’t normalized to a baseline, `S` encompasses the popularity of the stock (Tweet Volume) while also gauging the tone (Sentiment).

Monthly

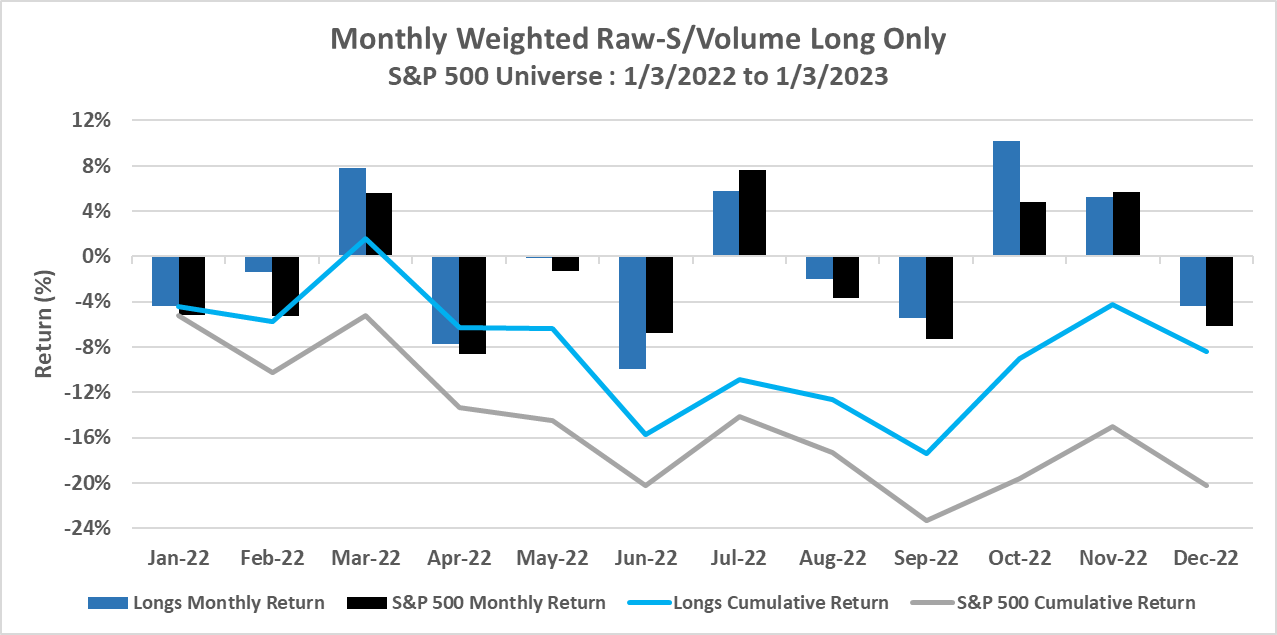

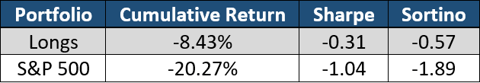

For this monthly holding strategy we look to accumulate a different 24-hour metric named Raw-S, which is the unweighted sentiment from Tweets received in the previous 24-hours on a security.

At the end of each month, take the Raw-S from each day and exponentially sum these values (lambda = 0.9) by security so sentiment from more recent days Tweets are weighted heavier than Tweets from 20+ days prior. This summation is divided by the total number of Tweets in the month by security to create a standardized score across all securities.

Based on the Monthly Weighted Raw-S per Tweet metric, the top 50 securities are placed into the Longs portfolio below. The monthly rebalancing occurs at Market Close of the first market day of each month. Securities are equally weighted within the portfolio.

Similar to the weekly portfolio earlier, the Longs portfolio did decrease in value but beat the S&P 500 by more than 10% in 2022. This portfolio outperforms the benchmark in 9 of 12 months this year, contributing to the large difference in Sharpe ratio.

Aggregating different S-Factors as described in the strategies above, gives users a view on how long-term social media sentiment in financial communities can impact future returns. The S-Factor feed encompasses 15+ unique metrics which can be used to create your own custom factors. This previous year has proven that Context Analytics’ S-Factors are predictive in bearish markets.

Context Analytics is the leader in unstructured data. To learn more about our products or to trial S-Score ContactUS@ContextAnalytics-AI.com.