Context Analytics 2024 Rundown

It has been an exciting year at Context Analytics. This year we released new products, improved existing products, and integrated exciting innovative technology. Powerful things are planned for next year so please stay connected. Most of all, we are grateful for the support of our customers and partners. If you have looked at our data in the past or are thinking about textual data for this coming year, please contactUS@ContextAnalytics-AI.com. Either way, please enjoy the below summary of Context Analytics' 2024.

Social, Twitter, and StockTwits Oh My!

In 2024, the U.S. stock market experienced a record-breaking year, with the S&P 500 reaching unprecedented highs, fueled by the exceptional performance of major technology companies. Amid this historic bull market, sentiment-based strategies leveraging Context Analytics' S-Factor feed demonstrated remarkable resilience and consistently outperformed benchmarks, underscoring their effectiveness even in favorable market conditions.

Twitter and Stocktwits continued as predictive sources for anticipating market movements. Context Analytics applies advanced Natural Language Processing (NLP) techniques to analyze and score messages from these platforms based on sentiment, transforming unstructured data into actionable insights.

The S-Factor feed aggregates these sentiment scores and standardizes them by security, offering key metrics like the S-Score. The S-Score, which measures sentiment on Twitter and Stocktwits, has proven predictive for security price movements both intraday and over a 2-3 day horizon.

A daily-rebalanced portfolio strategy utilizes these insights to trade securities from one market close to the next. Securities with an S-Score ≥ 2 before market close—indicating abnormally high sentiment—are included in the Long portfolio. Conversely, securities with an S-Score ≤ -2—indicating abnormally low sentiment—are included in the Short portfolio. Both portfolios are equally weighted, and the equally weighted S&P 500 constituents (RSP) serve as the benchmark.

The Long portfolio for both Twitter and Stocktwits outperformed the RSP benchmark, while the Short portfolio underperformed significantly. These outcomes highlight the power of sentiment-based strategies in navigating and capitalizing on market movements.

🚨Breaking News🚨

The Unstructured Data Terminal, UDT, dashboard is a user-friendly interface designed to cater to individual preferences with customizable display options. It features over seven dedicated widgets focused on sentiment analysis, delivering valuable insights into investor sentiment and market trends.

This year, we introduced our Quantitative News Widget, a tool that processes thousands of articles daily to provide a broad view of financial news across thousands of securities. The feed offers article-level sentiment metrics, which can be aggregated over time to identify potential trading signals. With over three years of historical data, our research highlights the benefits of using financial news to inform trading decisions. By analyzing the ratio of positive sentiment hits to total sentiment hits at the daily level for individual tickers, we observed alpha opportunities. Segmenting tickers into daily quintiles based on this ratio showed a monotonic spread in close-to-close trading performance, indicating the predictive potential of this metric and the overall feed. Incorporating financial news into the UDT allows for more informed and data-driven decision-making.

Whether you are tracking news, analyzing sentiment, or making data-driven decisions, our enhanced offerings provide the tools you need to stay ahead in an increasingly interconnected world.

New Product Alert

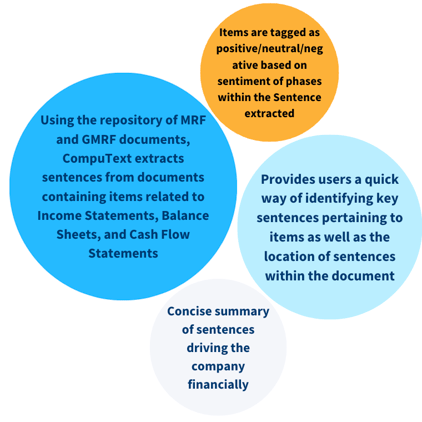

This past year, we released CompuText. CompuText is an addition to our Machine-Readable Filings product and Global Machine-Readable Filings (GMRF) products. GMRF is a rich data set of over 2.3 million foreign financial documents, such as magazine-style articles and annual reports, that have been converted into machine-readable API feeds. The GMRF not only saves time but also enables businesses to make informed decisions based on comprehensive insights derived from the real-time processed reports. The only thing that could make it better is adding in CompuText.

CompuText gains insights from textual data in corporate filings and earnings calls, by searching and tagging relevant sentences discussing financial items found in Income Statements, Balance Sheets, and Cash Flow Statements. These sentences are extracted and tagged based on rules created by CFAs and CPAs with PhDs in Accounting. Users can transform Computext extractions into customizable metrics through aggregating data by different Topics and Document Types. Currently available via FTP, this feed will be expanded to also be delivered via JSON API and Snowflake in 2025.

This product addition augments GMRF/MRF products by identifying financial statement items and the drivers of those items in the parsed filings. CompuText offers verifiable structured extractions for greater reliability & higher accuracy than standard ai.

Same, But Different?

We improved existing products by adding new fields to the API, enhanced visuals, and more robust front ends. We strive to provide context around sentiment, so we added AI summaries to the JSON feed. Every minute we publish a rolling AI generated summary of messages from our certified accounts. In addition, we expanded our conversation tagging on news and social media to provide more details around the conversation. This year we released a relationship widget to illustrate real time conversation links between securities and identify new links. Our front ends expanded to provide more powerful linkages between data sets and better screening, alerting, and searching across those datasets.

This year we integrated AI into our technology stack. We are using AI to augment our parsing technology, summarize messages, and interrogate documents.

If You Haven't Heard.

In 2024, we launched the AI-Generated Summaries, a Gen AI-powered solution designed to provide context around our traditional sentiment metrics and simplify how information can be consumed and acted on.

This extra layer of analysis helps clients understand not just what is said about a company, but also the underlying social media conversation and potential implications of these discussions. The textual context to sentiment analysis can be particularly valuable for traders and investors looking to gauge market reactions to breaking news or emerging trends.

Keep an Eye out!

In 2024, we have worked on WELS (Well Extraction and Logging System), the ultimate solution for transforming complex information into actionable insights. WELS collects vital Oil and Well Completion documents from 8 state entities, converts more than 2,900 intricate PDFs into machine-readable JSONs, and standardizes ingredient details.

Our powerful AI solution goes further by parsing multi-page perforation records and detailed stimulation data per stage, delivering a minimum of 18 essential fields in every JSON output. With instant access to clean and structured data, oil and gas companies can drive smarter decision-making, optimize operations, and boost financial performance.

Unlock the full potential of your oil and gas data with WELS.

✮ BTS ✮

2023 was all about getting MORE tools for data monitoring and analysis, MORE data sources, and MORE AI capabilities.

Ultimately, we are a data analytics company, so our main priority is obviously to develop tools to help analyze data. This year, we introduced new features in UDT to support diverse use cases such as, global data availability, multiple watchlists for monitoring, configurable widgets for personalization, and integration of additional social media sources like Twitter, Stocktwits, and Reddit as well as News.

As far as new data sources go, we expanded data coverage with NYSE Stocks, Pan European, NSE, TSX, TikTok, and Corporate News, enabling broader and more diverse data sources. We have also upgraded quite a few tools. To highlight a few, we introduced specialized tools for identifying fraudulent activities on social media platforms, implemented AI-driven clustering for dynamic topic and trend analysis, developed an AI chatbot for Retrieval-Augmented Generation (RAG)-based interactions with the Filings product, and enhanced AI capabilities with new Llama 3.0 to train and generate in-house reports and produce more robust AI Products for clients.

We aren't done, but it's been fun!

We hope that 2025 will be just as exciting and productive as 2024! A huge thank you to all of our partners and customers for making it such an amazing year. Please reach out with any questions, or just to catch up! We would love to hear from you!

Cheers,

Your friends at Context Analytics

.png?width=1000&height=500&name=happy%20Holidays%20(4).png)